This is a topic that we get asked about all the time – what is the best investment, property or stock markets?

There is a lot of misinformation around this topic, as well as huge levels of unconscious bias – people tend to know more about property and therefore lean towards what they know.

This difference in knowledge leads to property feeling “safer” – it’s also a tangible asset, which we can see, touch, and understand more easily than the perplexity of the stock market, which doesn’t usually feature so prominently in our day to day lives.

Everybody remembers the house they grew up in, but they don’t remember their parent’s investment portfolio.

This is even more true for anyone who has professional knowledge of property – people working in construction or architecture often overweight their investments far too much towards property.

However, property is still an investment, which carries its own risks and rewards, and we need to assess its suitability just like with any other type of investment.

So, let’s get into it and answer the question – property vs. stocks, what is the best investment?

But what is an investment?

First of all, I’d like to remind everyone of what an investment actually is. At Abacus, we have a robust and evidence-based investment philosophy and we believe it’s critical to ensure your investments are indeed “investments”, and not just “speculation”.

An “investment” by definition is expected to produce a future stream of income.

A “speculation” on the other hand, does not. A speculation is a gamble (think gold, currencies, commodities, cars, fine art, or even crypto). These are usually shiny and exciting things that capture the imagination. It’s important that you remain disciplined and ensure that your portfolio consists only of “investments” and avoids speculation.

Property and stocks are both types of investments.

But how are they investments?

Although they feel quite different, we are simply talking about owning a property versus owning a business (or shares/stock of that company). Both property and stocks will generate a return in similar ways – through asset value growth and income.

Property:

- Growth – the value of the property rising over time.

- Income – rent is paid by the tenant to the owner.

Stocks:

- Growth – the value of the company rising over time.

- Income – company profits are paid out by the company via dividends to shareholders.

Pros & Cons to Consider Before Investing in Property:

Pros:

Returns:

Either through growth or income, property offers inflation beating returns, ensuring the purchasing power of your money is protected over time.

Income generation:

Rental income can be used to create a passive income for yourself, without eroding the capital value of the investment/property.

Diversification:

If you are fortunate enough to hold a large investment portfolio of stocks already, property can be a good diversifier.

Tax efficiencies:

Mortgage costs on Buy-To-Let properties are subject to basic rate tax credits (20%).

Ability to gear/leverage:

You can invest in property via debt, using a mortgage. You can purchase a property with a small down payment (often 20% or less) and finance most of the property’s cost. You’ll then benefit from growth on the entire asset, though this does carry risks you should be aware of in advance.

This can also be done with stocks, but can be quite complex and carry unique risks.

Personal benefits:

You can live in the home yourself. It can create a stable environment for your family, encourage you to become more involved in the local community given you have a more permanent link, and you can create happy memories there.

Cons:

Dependent returns:

Either through growth or income, the potential returns that can be earned by investing in property can be heavily dependent on its location, the type of property, and local factors beyond your control.

It’s difficult to achieve diversification:

Unless you are significantly wealthy, it’s too expensive to own 30+ properties and virtually impossible to own 10,000+.

Therefore, it is impossible to diversify away the high-risk profile of a concentrated investment.

Vacant periods:

Can quickly erode the income stream.

Bad tenants:

If you ask any landlord about their worst experience, almost all of them will have a story about “the bad tenant who ruined the place and ran”.

Maintenance costs:

Can be unpredictable (and often large), which needs to be planned and budgeted for.

Loss of income:

If you invest in property as a second home to enjoy for yourself, then your return will come from growth only (unless you rent the property out during vacant periods).

It’s time consuming:

Managing and letting a property takes time and effort, which is often the last thing busy professionals want. This usually becomes more difficult and time consuming the further away you are from the property, which is an additional factor to consider as an expat.

High initial costs:

On a property purchase over £125,000, Stamp Duty will be payable, ranging from 2% up to 12%.

On top of this, there are significant transaction costs involved, such as survey costs, mortgage valuation fees, mortgage arrangement fees, lawyer fees, transfer fees, life insurance costs, removal costs, furniture, white goods and redecorating costs, or taxes.

High ongoing costs:

While the headline rental income figure might sound good, it’s important to ensure you’re still happy with it net of costs – water, gas and electricity bills, TV and Wi-Fi, council tax, building and contents insurance, service charges, maintenance and building work, and perhaps even ground rent or parking fees in some circumstances.

As a rule of thumb, expect to spend 1%-2% of the property value on maintenance each year. For example, this could be up to £20,000 on a £1m property.

Additional management costs:

You could employ an agent or property management firm to look after this for you (oversee letting, find and deal with tenants, resolve issues, etc.), but this will incur additional costs, typically 10% of the rental income.

Not as tax efficient as it has been historically:

Mortgage costs on Buy-To-Let properties are now limited to basic rate tax credits only (20%), making it far less attractive for higher and additional rate taxpayers.

High sale costs:

You will incur estate agent fees for selling your house. In 2022, the average range for estate agent fees was 0.9% – 3.6%.

Additional taxes:

Upon sale of the property you will also be charged an additional 8% capital gains tax (so either 18% or 28% depending on your tax band).

Exposing yourself to UK tax:

Although this only applies to expats, it is a big one. Particularly in the UAE, when people have moved to a zero-income tax/zero capital gains tax jurisdiction.

By investing in UK property, you are volunteering to pay UK tax again. You will be subject to income tax on the rental income (0% – 45% depending on the level of income) and capital gains tax (18% – 28% depending on the gain).

It’s illiquid:

You can’t convert property into cash (to spend!) quickly or easily.

This will take time (often 6 months +) and you won’t have any flexibility to tailor it to your needs (if you need £50,000 and have a £1,000,000 property, you can’t sell a bedroom – you’ll have to sell the entire property and then face the additional headache of what to do with the other £950,000).

No compound growth:

Although the property will likely grow in value over time, this will not compound – i.e. returns on your returns.

Rental income will be paid out and cannot easily be reinvested back into the property for further growth. As such, you will have to think of another way to invest this income productively (or see it build up in cash, eroded by inflation over time).

Estate Planning:

It’s very difficult to manage your estate or plan for inheritance tax with property.

In most cases, property will sit within your estate and take up most, if not all, of your allowances – resulting in a potential 40% inheritance tax bill on death.

Pros & Cons to Consider Before Investing in Stock Markets:

Pros:

Higher returns:

Stock markets have outperformed property over any meaningful time period.

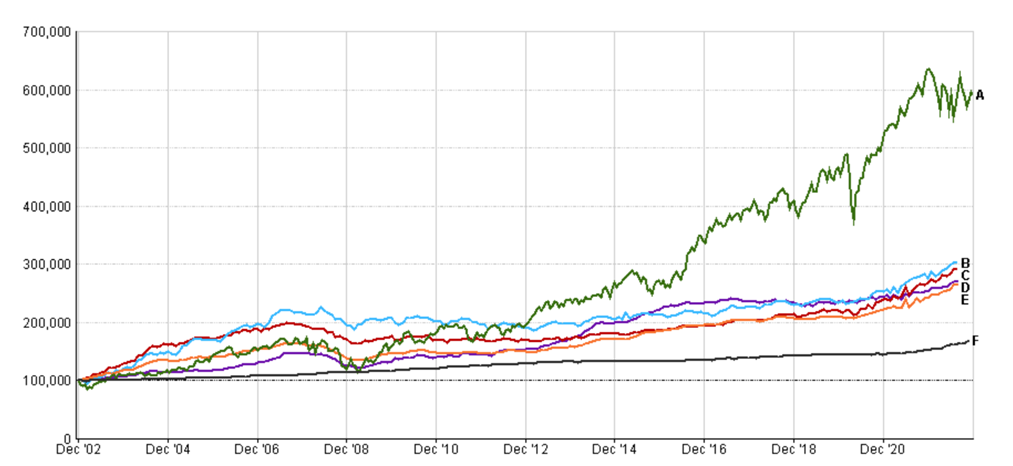

The chart below shows the results of £100,000 invested in UK property vs. global stock markets over the last 20 years:

A – Global Stock Markets (MSCI ACWI): £100,000 ➦ £590,903.34

B – UK House Price (Scotland): £100,000 ➦ £303,289.93

C – UK House Price (Wales): £100,000 ➦ £291,683.33

D – UK House Price (London): £100,000 ➦ £272,929.47

E – UK House Price (England): £100,000 ➦ £266,203.62

F – Inflation (CPI): £100,000 ➦ £168,491.32

This picture doesn’t change by looking at different time periods or regions either – a dollar invested in the S&P 500 (i.e. the US stock market) in 1945 would be worth over 50 times more today than a dollar invested in US housing. Housing grew at 4.6% per annum, while stocks grew at 10.6% over the same period – with a time period of over 70 years, this compounds into a huge difference today.

And Robert J. Shiller – a leading economist at Yale, a Nobel prize winner for his empirical analysis of asset prices, and academia’s most prominent housing expert – arrives at the same conclusion too.

He measured US house prices from the 1890s to 2016, and his data showed that the annual rate of real (i.e. adjusted for inflation) return of house prices was just 0.4%.

To put it simply, house prices have protected owners from inflation, but have not provided any meaningful return above that.

Liquidity:

Unlike property, an investment portfolio of stocks can easily be liquidated, either in full or in parts.

If you need money quickly, the sale is ordered that day and the amount you need is back in your bank account within a couple of days.

Easy to achieve diversification:

With stocks, it’s possible to build a globally diversified portfolio across all geographies, industries, and types of companies.

This can be done at a fraction of the time and cost it takes to own a diversified portfolio of properties.

Lower initial costs:

There are virtually no costs associated with setting up an investment portfolio or buying stocks.

If you have never done this before and wish to work with a professional Financial Planner, then there will be associated costs for the advice you receive, though this will remain comfortably less than the costs associated with property.

This would also be a one-off fee at the beginning of the client/adviser relationship, rather than anything to do with the investment portfolio specifically.

Lower ongoing costs:

Investing further amounts in future would incur virtually no costs, while further investments into property will incur initial costs each and every time you purchase a new property, including additional stamp duty of 3% for additional properties on top of the usual costs.

Ongoing management will also typically be cheaper, at 1.3% – 2.5% per annum all in (including all costs – professional advice fees, product fees, investment costs, etc.).

More tax planning opportunities:

You can grow your investments within tax-free and tax advantaged accounts.

The greater flexibility also allows you to make use of your tax allowances each year, particularly useful when planning to draw an income from your assets.

Similarly, there are significantly more options for estate planning. From inheritance tax efficient investments, to gifting strategies, to trusts.

All of these are either difficult or impossible with property, which will usually just sit within your estate and take up most of – if not all of – your tax allowances (particularly relevant for families whose assets exceed £1m).

Easy and hassle-free:

Nobody lives in your investment portfolio, so it won’t damage anything, you’ll see no disrepair, and it won’t call you in the middle of the night about a broken boiler!

Ongoing maintenance will be far easier and cheaper. It will take up far less of your time, meaning you can spend that time elsewhere – either productively in the areas you’re skilled in, increasing your income, or on the things in life you enjoy doing, increasing your quality of life.

Cons:

Visible volatility:

The market updates stock prices every nanosecond, so you can see this live.

Although this does not necessarily mean it’s riskier, it does create a lot more visibility which can have a negative emotional and psychological impact.

In contrast, if you look in your front garden, there is no digital board displaying the last price a nosy passer-by was willing to pay for your house.

Although this is ultimately a good thing – because it means liquidity and your ability to convert funds into cash almost instantly – it can be stomach churning.

Accessibility:

Although this is an overall positive, it can have the negative side effect of being too tempting to access your investment portfolio.

Given it’s almost as easy as accessing money in your bank account, it can test your discipline and be a little too easy to touch your savings. In contrast, it takes a lot before you consider trying to access savings tied up in property.

Poor decision making:

Just because you can buy and sell stocks more easily than property, doesn’t mean you should.

Emotional and behavioural biases, fear and greed, knee jerk reactions, and many other factors can lead to poor decision making and there is a real risk of eroding the portfolio quicker than desired.

This is one of the many reasons why working with a professional Financial Planner, to help support and guide you, results in better outcomes (adding an additional 3% p/a according to Vanguard studies).

It’s easy to make mistakes:

A well-constructed globally diversified portfolio in line with our evidence-based investment philosophy is the academically proven way to deliver long term returns.

However, this can be challenging to build in practice and the investing universe can be daunting, with hundreds of thousands of funds, financial instruments, and share classes to select from.

It can also be tempting to invest in individual companies or start to “trade” and “speculate” rather than “invest”.

The vast majority of investors don’t capture market returns because of poorly constructed portfolios, mistakes, or bad behaviour.

Investors should always take a long-term view with any investment, be it property or stocks, and a “buy and hold” strategy almost always produces greater results.

Conclusion:

There are many fantastic reasons to buy property, and we always support our clients in doing so.

Property almost always plays a role in a client’s financial plan, be it for personal benefit or to provide additional diversification benefits to a wider investment portfolio.

But the data shows that property isn’t a good alternative to a well-constructed stock portfolio, so the decision to purchase a property should generally be made because it will optimally enhance your life, not your finances.

This largely comes down to the fact that businesses are more productive than property – they aim to innovate, produce goods and services, and ultimately exist to maximise both earnings and the growth of those earnings in the future. Whereas houses do not exist to create value, and their values are based more on the local economy and supply and demand.

To finish on a quote from Nobel Laureate Robert J. Shiller, “If you look at the history of the housing market, it hasn’t been a good provider of capital gains. It is a provider of housing services… To me, the idea that buying a home is such a great idea is just wrong.”

As always, please do get in touch if you’d like to discuss anything in this article, or indeed your own experiences. One of our experts would be delighted to sit down with you for a coffee and a chat – you’re guaranteed to leave better informed or with food for thought. Or at least a free coffee!

By Adam Dalby – Chartered Financial Planner

Please keep in mind that, whilst we aim to update these articles periodically, the content could be subject to future rule changes. Always make sure to speak to a qualified professional to ensure you have the most up to date information and are taking regulated advice around your specific circumstances.