Retirement is a time to sit back, relax, and enjoy the fruits of your labour. But how will you fund this luxurious lifestyle? Enter the UK State Pension, your golden ticket to supplementing your financial freedom in your golden years.

State Pension is one of the most underappreciated and underutilised tools in the average expat’s arsenal.

Whilst it might not seem like much, the UK State Pension will provide almost £12,000 p/a of guaranteed inflation proofed income.

No investment risk or volatility to worry about.

No inflation to worry about.

Just spend it and enjoy it.

In this article, we will explain everything you need to know about State Pension – why it’s so important, and how to make sure you get it.

Is State Pension Really That Valuable?

Yes.

The full new State Pension is £221.20 per week (rising to £230.25 in April 2025).

Plenty of people – especially expats enjoying a nice standard of living – turn their noses up at such a small number.

But not so fast!

That translates to £11,976 per year.

Think about what it would take – or what it would cost – to generate that level of income from your savings:

a) First, let’s look at a standard safe withdrawal rate of 4%, which is often quoted by financial media (this number is flawed, but still a useful guideline for the purposes of this exercise).

At a 4% withdrawal rate, you would need a savings pot of £299,400 to generate £11,976 of income.

Now consider that you would still be exposed to investment risk, market volatility, and the impact of fees and charges. You would need to manage the investments on an ongoing basis, and plan withdrawals to avoid sequencing risk – this is a lot more work than simply accepting money from the government for a State Pension!

And if you don’t keep that money invested, then you will see your £299,400 cash pot eroded by inflation – based on the Bank of England’s inflation target of 2%, your pot of £299,400 would only be worth £245,000 by 2035 (and that’s only if the Bank of England meet their inflation target…). Meanwhile, State Pension is inflation proof and so would increase each year by an inflationary rate – so it would retain its value of £11,976 p/a of income (or a lump sum pot of £299,400) in today’s terms.

b) What if I buy guaranteed income by purchasing an annuity?

Looking at current annuity rates, the picture would not change much – you would still need to pay over £200,000 to purchase an income close to that provided by State Pension.

Therefore, do not underestimate the value of State Pension – for a married couple, it’s worth almost £600,000.

How else will State Pension impact me?

It’s also important to remember the trade-offs involved with a State Pension too.

Without a State Pension, you will have to start withdrawing more money from your savings to fund your lifestyle.

This comes with its own set of drawbacks as you start to plan for withdrawals, reduce investment risk, and pull your savings away from growth assets.

Therefore, a State Pension provides a “double sided benefit”:

1) Firstly, the guaranteed income.

2) But secondly, you do not need to make the equivalent withdrawal from your savings to fund your lifestyle. Thus, your savings can continue to grow.

To give an example – for a married couple, that is a pot of almost £600,000 that is remaining untouched, can remain fully invested for longer, and will continue to grow and compound for you both into the future. Thus, it will also provide a much larger future savings pot, from which you both can fund a more luxurious lifestyle in later years, or use for estate planning, gifting, or charity.

Whatever the use, it will provide the maximum number of options and greatly assist with the sustainability of your savings over your lifetime.

A Quick Case Study – What does this look like in real life?

Take John & Jane, a real (but renamed) couple, and Abacus clients.

They have the standard expat story, currently living in Dubai but wish to retire back to the UK in a few years’ time.

Outside of their main home, their assets consist of various cash accounts, a joint General Investment Account, a personal pension (SIPP) each, as well as an investment property in the UK.

As with all our clients, John & Jane have a formal Financial Plan in place.

Cash flow is a key part to our professional service (for ‘Holistic’ service level clients), that allows them to look at their entire financial situation, visualise their life in numbers, and plan ahead for the future.

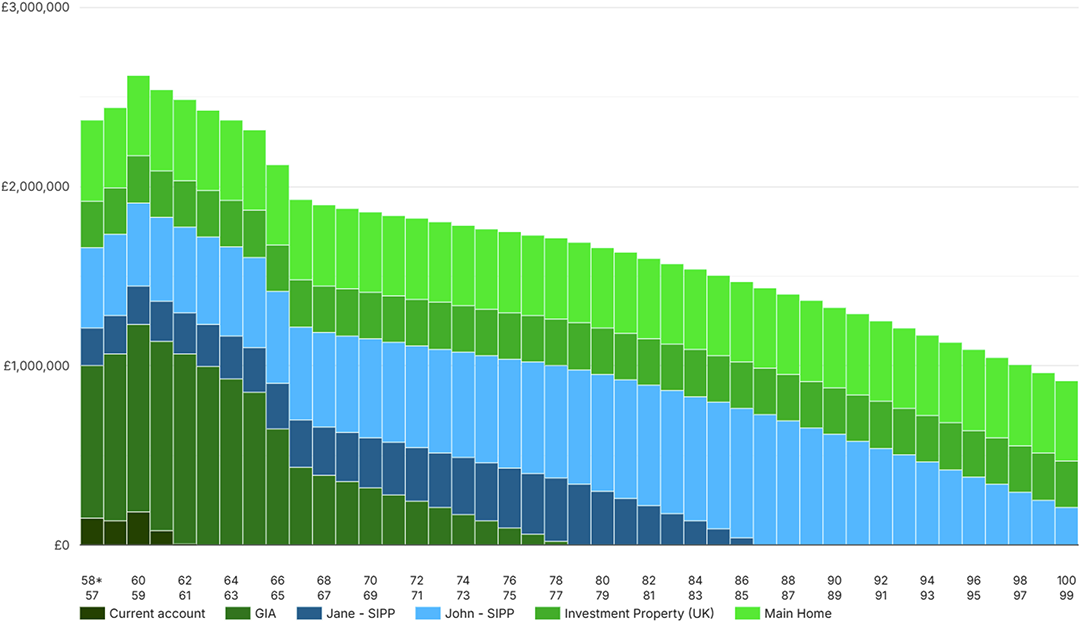

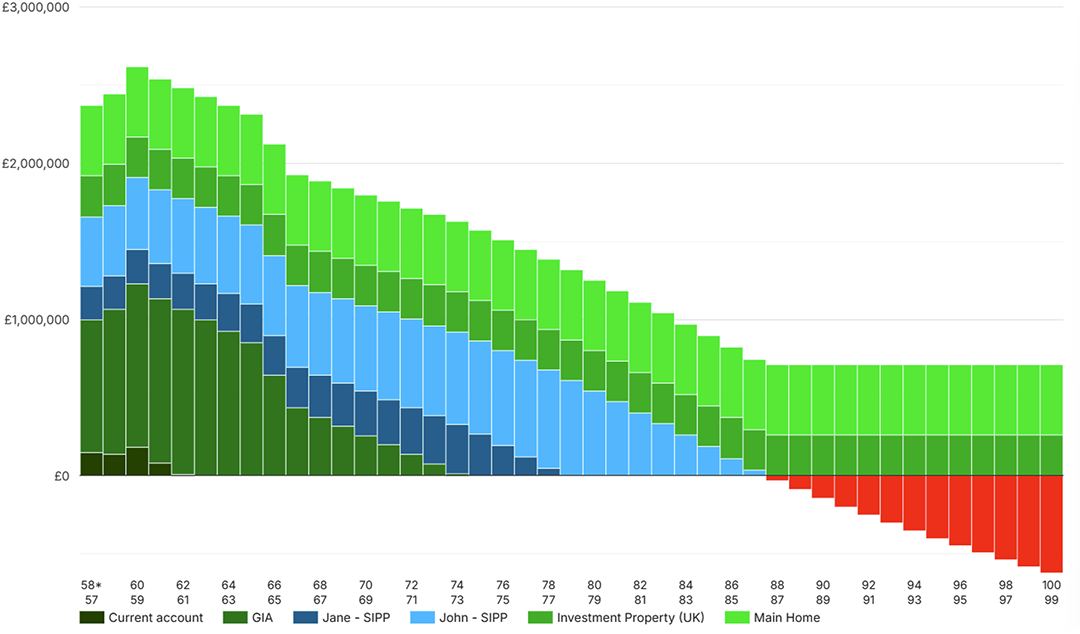

Below you can see two versions of their financial future – one in which they both qualify for full State Pension, and the other in which they don’t.

Both scenarios are identical otherwise.

With State Pension:

John & Jane have comfortably enough to support their desired lifestyle for the rest of their lives.

The model predicts them passing away at age 100, and there is still c.£900,000 left between John’s SIPP and the two properties, which could be passed on to their daughters completely free of Inheritance Tax.

Without State Pension:

John & Jane’s Financial Plan fails, and they run out of money in their mid-late 80s.

Not only does the inheritance effectively disappear, but over a decade of their retirement spending too.

They would have to sell their UK investment property first, and thereafter their home, just to manage monthly expenses into their mid-90s

Overall, simply qualifying for full State Pension creates a difference of £830,000 to their net worth at age 100.

How do I make sure I qualify for Full State Pension?

So, you now understand the value of State Pension!

The amount you receive is based on your National Insurance (NI) record.

You will need to make 10 years of National Insurance Contributions (NICs) to qualify for any State Pension, and 35 years contributions to qualify for the full amount.

(i.e. you receive 1/35th of Full State Pension for each year of NICs, subject to a minimum of 10 year’s contributions).

The State Pension age for both men and women is currently 66, and will increase to 67 between 2026 and 2028.

Below is a checklist to make sure you collect full State Pension when the time comes:

1. Check Your NI Record & State Pension Forecast:

Your NI record will tell you how many years contributions you have and if there are any gaps in your record, while your State Pension Forecast will show you how much you will receive according to your current and projected contribution level.

You can do this via the government website, here.

You’ll just need your Government Gateway user ID & password (if you don’t have one, you can set one up via the same link).

You will be asked some security questions, so you will also need your passport and National Insurance number.

Overall, it’s quite straightforward and should only take 10 minutes to complete.

2. Once you have your NI Record & State Pension Forecast, decide if it makes financial sense to fill gaps or not:

Your NI record will clearly show how many year’s contributions you have, and how many more you must make.

The decision to make up gaps will be different for everyone – for example, younger people might not consider the expense worth it if they are on track to have 35 full years of contributions before they hit their State Pension age anyway.

However, for older people who might not have enough time left to reach 35 years’ contributions before State pension age, filling in gaps can be an incredibly valuable exercise.

3. Pay NICs:

Expats do not pay standard class 1 NICs as they no longer work in the UK.

However, you can still pay voluntary contributions (either class 2 or 3 contributions).

Most expats qualify for class 2 contributions, which are the cheapest level – just £3.45 per week (or £179.40 per year).

If not, you can still pay class 3 voluntary contributions, which are still very cheap at just £17.45 per week (or £907.40 per year).

HMRC will determine which class of contribution that you qualify for, but generally speaking, you can pay Class 2 contributions for the period you are employed or working offshore. Note – the government gateway will show and allow you Class 3 contributions gap fills, and so it’s important to reach out to them to check if you qualify for the lower cost Class 2 contributions.

4. Fill in gaps in your NI record, if beneficial for you:

You can go back up to 6 years to fill in gaps in your NI record.

It’s also worth checking these years to see if some might be cheaper. In some circumstances – such as the year you left the UK – only partial contributions may have been made. This means that it might only take a small payment to complete the gap for that year. Fill these gaps first, before turning to the full year gaps.

5. Stay on top of it!

Once you have filled in gaps in your NI record and have everything up to date, you have done the hard work – so make sure to stay on top of it moving forwards.

You can continue to pay class 2 or 3 voluntary NI contributions on an ongoing basis, which can be done easily via direct debit so that you don’t have to think about it ever again (set and forget).

6. Be Aware of the Limited Window Ending 5th April 2025:

As mentioned, under normal rules it is only possible to make up gaps within the last 6 years – after that, the year in question becomes a permanent gap in your NI record.

However, for a limited period – until 5th April 2025 – you are allowed to make up any gaps from 2006/2007 onwards.

As such, there is a unique planning opportunity for anyone with a poor NI record (very common amongst long-term expats) – especially anyone in their 50s or 60s, who may not build up the full 35 years and qualify for full State Pension otherwise.

If taking advantage of this, remember that you will always be able to go back 6 years – so if you’re keeping an eye on cost, it’s usually better to target earlier gaps, as gaps from 2019/2020 onwards will still be available for you to sweep up again next year.

Conclusion:

All in all, the UK State Pension is a fantastic source of guaranteed income for retirees, yet greatly underappreciated – and even ignored – amongst the expat community.

It provides a basic level of income that’s not means-tested, is easy to claim, and can be claimed from anywhere in the world (so even if you’ve got used to the warm weather and don’t plan to retire in the UK, you’ll still get it!).

In some cases, making up gaps can be incredibly valuable. In other cases, money could be better spent elsewhere – if in doubt, you should reach out to your Financial Planner and have a conversation to make sure you do what’s right for your own personal circumstances, especially given the ticking clock on the April 5th 2025 deadline.

If you don’t have a Financial Planner, we’d be delighted to help – feel free to get in touch here.

Then, once you reach State Pension Age with a full NI record (35 years), just sit back, relax, and enjoy your retirement partly covered by the UK State Pension!

By Technical Team @ Abacus

Please keep in mind that, whilst we aim to update these articles periodically, the content could be subject to future rule changes. Always make sure to speak to a qualified professional to ensure you have the most up to date information and are taking regulated advice around your specific circumstances.