When it comes to portfolio theory, there’s one core principle that continues to prove itself time and time again: diversification.

It’s often described as the only free lunch in investing.

With market turbulence returning in 2025 particularly in US equities – and geopolitical uncertainty undermining investor confidence, the spotlight is once again firmly on the importance of diversified portfolios.

First, What Is Diversification?

Diversification is the practice of spreading your investments across different assets, geographies, sectors and styles to reduce overall risk. Instead of relying on a single market or asset to perform, you build a portfolio that’s robust to a range of outcomes.

A well-diversified portfolio typically includes exposure to:

- Different asset classes (equities, bonds, property, cash)

- Geographic regions (UK, US, Europe, Asia, emerging markets)

- Investment styles (growth vs value, large-cap vs small-cap)

- Sectors (technology, healthcare, financials, consumer staples, etc.)

By doing so, you both reduce risk and optimise expected return – on one side, you reduce the impact any one underperforming area has on your overall wealth, whilst on the other, you ensure you capture the returns generated by the highest performing areas.

The 2025 Backdrop: A Clear Reminder

So far in 2025, the US equity market has had a rocky ride. Renewed trade tensions, the re-emergence of tariffs under the Trump administration, and concerns over interest rates have weighed heavily on investor sentiment. The S&P 500 has underperformed compared to its global peers, with many sectors lagging amid political instability and policy uncertainty.

By contrast, several international markets have quietly outperformed. European equities, buoyed by robust earnings and falling inflation, have delivered solid gains. Emerging markets, particularly in Asia and Latin America, have benefited from currency stability and strong commodity demand. In short, investors who were globally diversified have fared far better than those whose portfolios were heavily concentrated in US or single-country equities. In fact, at the time of writing this article, the US market is the only major stock market still in negative territory in 2025 (see year to date performance below, in USD terms):

Figure 1

This real-world divergence reinforces the most fundamental argument for diversification: different regions, asset classes and sectors behave differently at different times. Trying to predict which will outperform next is notoriously difficult – which is why spreading exposure broadly is a smarter, more sustainable strategy. This brings us nicely on to our next point…

The Data Doesn’t Lie – The Randomness of Returns

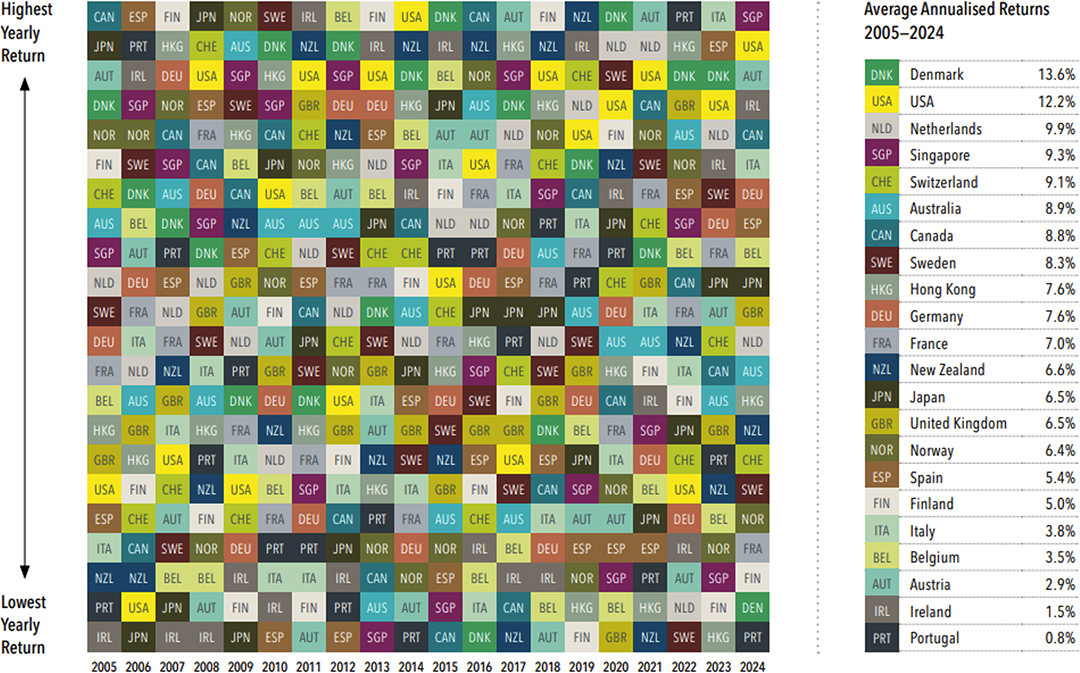

It is virtually impossible to predict which country will deliver the strongest equity market performance year on year.

The chart below shows the randomness of equity market returns, with the scattered colours illustrating just how difficult predictions are. For example, New Zealand posted the highest returns in 2019 but the lowest in 2021.

Despite heavily publicised (and undoubtedly strong) returns, the US stock market has only claimed the title of best performing stock market in the world once in the last 20 years – in 2014. Even on an annualised basis, Denmark has been the highest performing stock market over the last 20 years.

Investing in markets around the world can result in a more consistent experience – with higher returns in one market helping offset lower returns elsewhere – and help to deliver more robust and reliable long-term outcome for investors.

Annual Returns For Developed Markets, Ranked

2005-2024

Figure 2

Chasing Winners Is a Losing Game

One common trap investors fall into is chasing recent winners. If the US market did well last year, it’s tempting to allocate more there – but past performance does not guarantee future returns. In fact, returns tend to mean-revert: today’s winners often underperform tomorrow.

The New Zealand story above is a prime example of this. Without diversification, the impact on your portfolio could have been devastating.

A globally diversified portfolio cushions these swings. Some parts will outperform while others lag – but the overall experience is smoother, and long-term returns are more robust.

Behavioural Benefits

Diversification isn’t just about the numbers – it’s about human behaviour too. When investors experience large losses in concentrated portfolios, they’re more likely to panic and sell at the wrong time. Diversification helps reduce portfolio volatility, which can reduce anxiety and encourage long-term discipline.

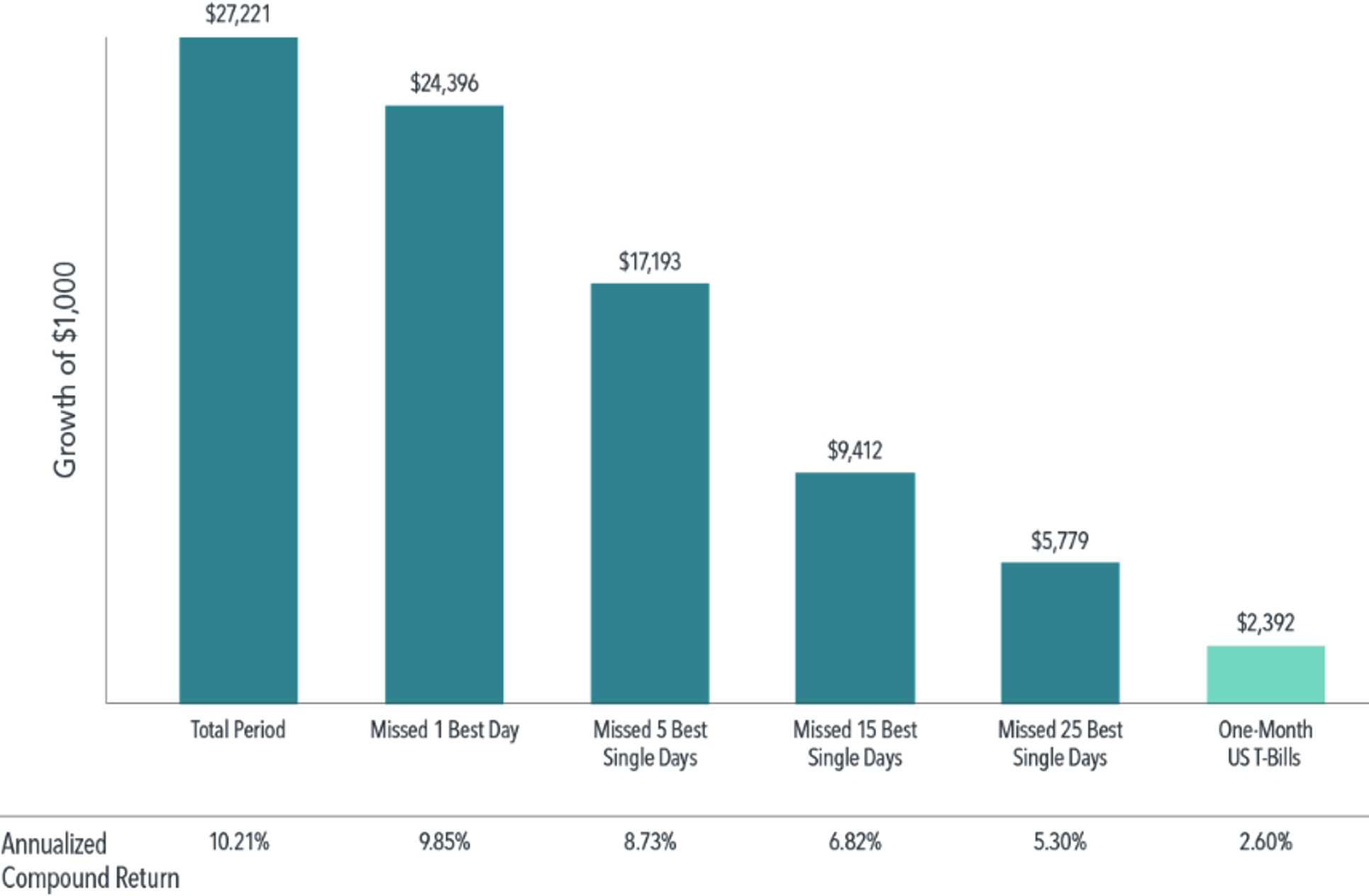

A smoother ride means you’re more likely to stay invested – and staying invested is half the battle. According to data from Dimensional (fig. 3 below), missing just the 15 best days in the market over the last 30 years would have cut your returns by 2/3rds! And those “best days” often come right after the worst ones – which is why staying the course matters.

S&P 500 Index Performance Based on Time in the Market

1990-2023

Figure 3

How Diversification Works in Practice

Let’s look at a simple example. Imagine you hold:

- 40% in US equities

- 4% in UK equities

- 16% in other global equities (Europe, Asia, Emerging Markets, etc.)

- 20% in government bonds

- 20% in corporate bonds and credit

Even if US equities fall by 10%, your portfolio won’t drop by 10% – because other components may hold steady or even rise. Bonds could provide stability, and other global equities might offset US losses.

This is the essence of diversification: protecting you from concentrated risk and helping you remain invested through uncertainty.

Today’s Volatility Is Tomorrow’s Lesson

The 2025 market environment is yet another reminder that uncertainty is part of investing. Political changes, unexpected policy shifts, trade wars, inflation surprises – these will always happen.

But your portfolio doesn’t need to react to every headline. In fact, the best strategy is often the most boring: build a globally diversified portfolio, established with your long-term objectives and risk profile in mind, and stick with it.

As financial planners, we guide clients to focus not on short-term noise, but on long-term outcomes. Diversification is a key part of that journey. It doesn’t guarantee an exciting investing experience, but it does remove the risk of permanent capital loss, reduce risk overall, smooth out returns, and increase the probability of you reaching your financial goals.

Final Thoughts

Diversification isn’t about avoiding losses – it’s about managing risk intelligently and capturing long term returns effectively. In a world that’s increasingly unpredictable, trying to pick the next winning stock, sector, or country is not only impossible – it’s unnecessary.

By building a globally diversified portfolio aligned with your goals, risk tolerance, and time horizon, you take emotion out of the equation and give your wealth the best chance to grow sustainably.

2025 has already reminded us of this timeless truth: no one market – not even the mighty US – can lead all year, every year, forever. But by investing across the globe and across asset classes, your portfolio doesn’t have to guess right – it just needs to cast a wide net and capture overall market returns effectively. So:

1) If you want to be in with a chance to win big next year – then make a concentrated bet and ignore portfolio theory. You may blow up your portfolio, but you may become a millionaire overnight!

2) But if you want to grow your wealth and achieve your goals 10, 15, 20 years from now – diversification is an essential component of portfolio construction.

If you have any questions or would like to discuss your own asset allocation decisions (or wider financial decision making), please get in touch and one of our qualified Financial Planners would be delighted to help.

By Technical Team @ Abacus

Please keep in mind that, whilst we aim to update these articles periodically, the content could be subject to future rule changes. Always make sure to speak to a qualified professional to ensure you have the most up to date information and are taking regulated advice around your specific circumstances.