Recent news headlines would have you believe that global stock markets have been on a rollercoaster recently.

It’s easy to get caught up in the noise when media outlets try to create – and capitalise on – fear and uncertainty.

But the truth is, for long term investors, this short-term volatility is of no relevance, and therefore should be of no concern.

In fact, it’s periods like this that remind us of the importance of having a clear Financial Plan underpinned by a well thought out investment strategy.

The Bigger Picture: Long-Term Growth vs. Short-Term Fluctuations

When you look at the historical performance of the stock market, a clear pattern emerges: despite periodic downturns, the overall trajectory is up and to the right.

Consider the performance of the MSCI World Index (an index that tracks the global stock market) over the past few decades. There have been many corrections, bear markets, and crashes — yet the index has consistently recovered and gone on to reach new highs.

For example, during the Global Financial Crisis in 2008, the MSCI World fell by almost 50%. It was a scary experience for investors and many questioned whether the market would ever recover.

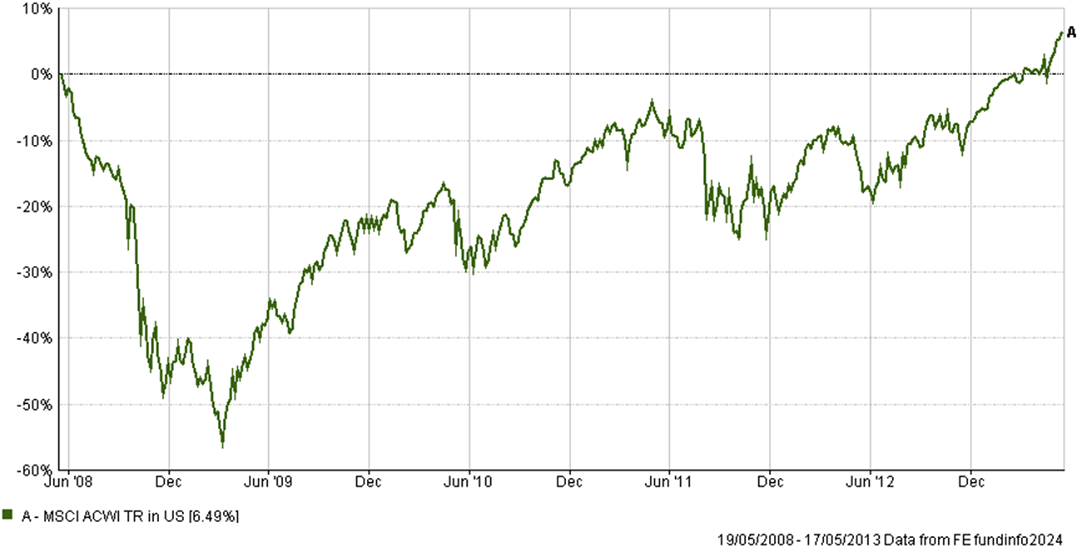

However, zooming out a little, below is the 5-year chart showing the MSCI World from May 2008 (the peak of the market before the 2008 crash) to May 2013 (exactly 5 years later).

Unsurprisingly, the index fully recovered over this period – which means that no disciplined investor lost money, and investors still accumulating (i.e. still working, saving and investing new cash into the market regularly) saw significant gains.

Keep in mind that 5 years is the minimum time period any investor should be looking at.

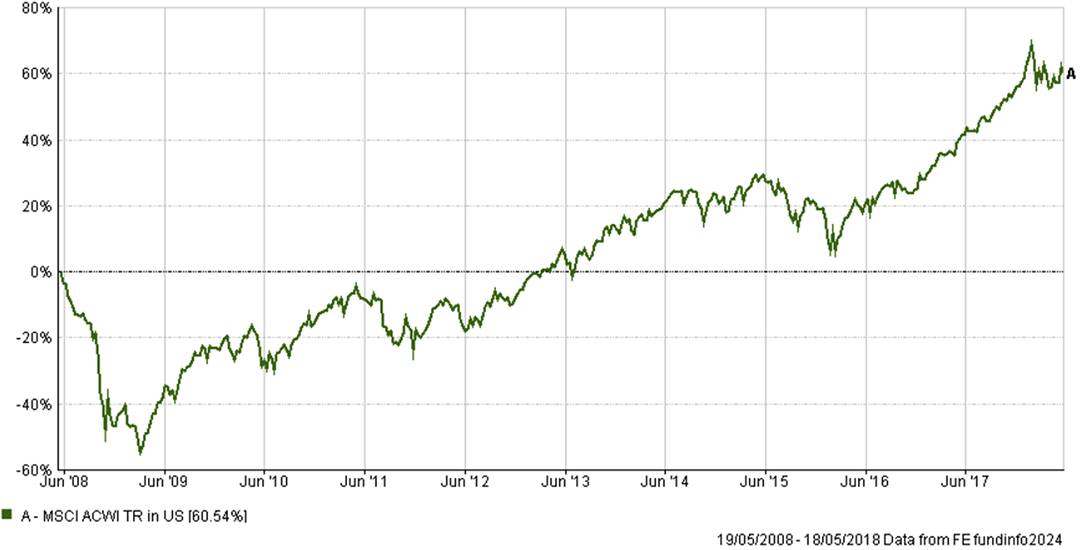

Zoom out a little further – over a more reasonable time period of 10 years – and the index rose over 60% in value:

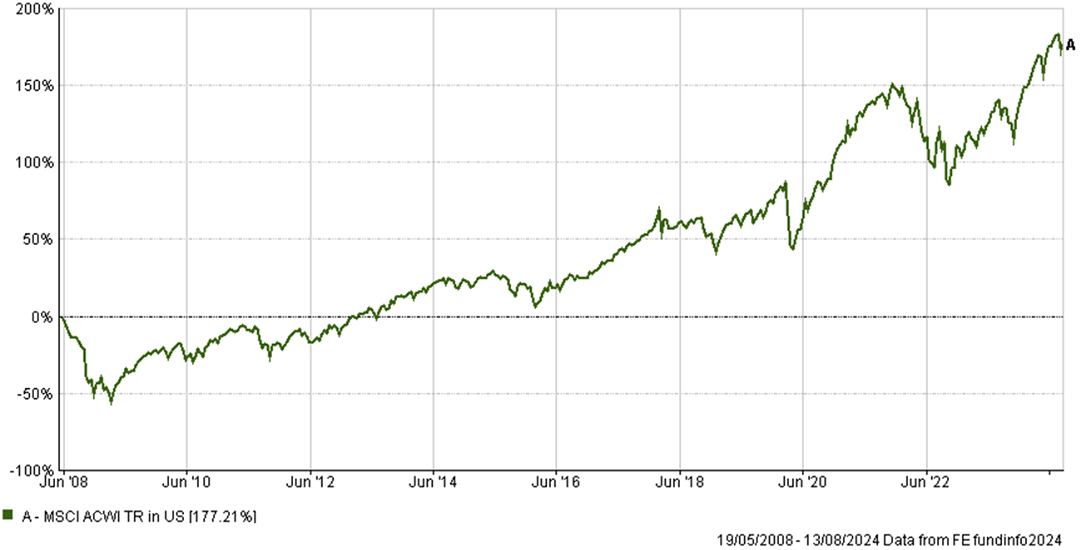

And finally, zoom out even further (all the way to today) – the index has risen over 2.5x in value, delivering over 150% returns to investors:

The morale of the story here is: market recoveries are not just possible, they are inevitable.

It’s worth noting that despite the recent volatility, many markets have already rebounded significantly – for example, the Nikkei 225 (a major Japanese stock market index) fell by 12% on Monday 5th August, then recovered almost immediately, up 10% on Tuesday 6th August.

A rapid recovery like this shows why short-term performance – especially over as little as one week – is irrelevant to long-term investors.

Downturns are often temporary, and the overall market trend remains upward.

Ignore the Noise: The Media Exaggerates the Importance of Market Volatility

The financial media plays a significant role in amplifying market volatility, and portraying it to be more important than it really is.

Market volatility is a feature of investing, not a bug.

However, financial media would have you believe it’s the latter.

Sensationalist headlines and pessimistic predictions are designed to grab attention, generate clicks and engagement, expand the reader base, and generate more revenue – this is great for the media company, but terrible for their readers (i.e. investors).

These headlines usually lack context and encourage poor investment decisions and bad investor behaviour.

Remember – media outlets generate revenue by selling stories, not by offering sound, rational financial advice.

It’s important to understand this distinction and to make sure you are making investment decisions based on things like your Financial Plan, your long term goals, and your risk tolerance – not based on meaningless reactions to the latest news cycle.

Focus on Your Long-Term Goals

When markets are choppy, it’s natural to feel anxious.

But an easy way to navigate this, is to remind yourself why you are investing in the first place.

Are you building wealth for your dream retirement? To buy a house? Or perhaps to pay for your children’s education?

These objectives are years, if not decades away.

Reacting to short term noise is probably going to be to the detriment of these goals, so reminding ourselves of these goals can really help to put things in perspective and help us to refocus on what’s important.

This brings us to an important point: how often you check your portfolio can significantly impact your perception of your investments:

Someone who checks their portfolio daily or weekly might find themselves worried about a dip in one week’s performance, leading to unnecessary stress. In contrast, an investor who checks their portfolio quarterly would see nothing but positive growth so far in 2024 — a very different experience.

By focusing on the bigger picture and avoiding the temptation to constantly monitor your investment portfolio, you can maintain a healthier and more optimistic perspective on your financial future (and markets tend to reward optimists and punish pessimists!).

The Importance of Staying the Course

The key to successful long-term investing is not “timing the market” but time in the market.

If you’re interested in exploring this a little further, you might benefit from reading our recent article on why market timing does not work.

To summarise this point, a study by Fidelity Investments found that an investor who stayed fully invested in the S&P 500 from 1980 to 2023 would have seen an average annual return of 11.51% (turning $10,000 into $1,082,309).

However, if the same investor tried to time the market and missed just the best 10 days in the market, their annual return would have dropped to 9.44% (turning $10,000 into $483,336).

This glaring difference highlights the danger of trying to time the market.

Conclusion:

Although market volatility can be unsettling, it’s important to remember that it’s a normal part of the investing journey – which is akin to a ship’s journey, and market volatility is like the weather along the way.

There will be periods of both calm and turbulence, sunny skies and storms. But as long as you have a clear destination in mind, the course has been set, and your ship has been well-built with all of this in mind, then you will reach your destination.

If you are working with a financial planner, then your goals are clear, your Financial Roadmap has been created, and your investment portfolio has been well-built with all of this in mind. It has been constructed to balance risk & return in a way that works for you, to withstand these storms and get you to your destination.

So stay in your seat, stay invested, stay focused on your long term goals, and history has shown us over and over that markets reward those who do.

By Technical Team @ Abacus

Please keep in mind that, whilst we aim to update these articles periodically, the content could be subject to future rule changes. Always make sure to speak to a qualified professional to ensure you have the most up to date information and are taking regulated advice around your specific circumstances.