Although we always encourage clients to tune out short term noise, we are aware that this noise has gotten a little louder than normal over recent months (particularly if you read a lot of financial media or consume a lot of US based news). Therefore, we felt it would be beneficial – and reassuring – to provide you with a quick run-down of what has been happening and what it means for you and your portfolio.

A Bold Move: The Liberation Day Tariffs

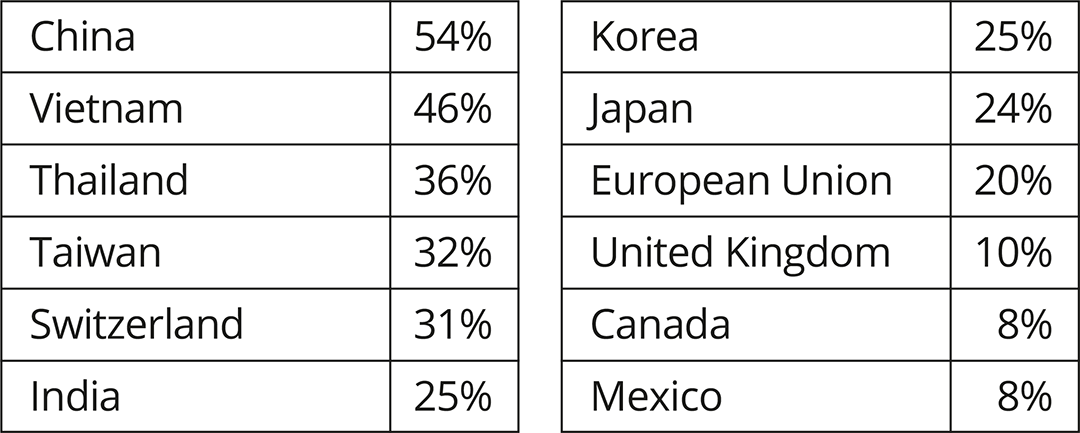

President Trump’s re-election has been swiftly followed by aggressive action on trade. On 3rd April, the White House announced a new tariff regime that significantly disrupts long-standing trade relationships. A blanket 10% tariff now applies to all imports into the US, with much steeper rates imposed on certain countries. China faces a staggering 54% tariff, while Vietnam, Thailand, and Taiwan have also been heavily targeted. Even traditional allies have not been spared – EU imports will be hit with a 20% tariff, while the UK will be hit with 10%. A full breakdown of the tariffs is listed below.

Trading Tariff Rates (%)

Source: BBC, JPMorgan

This latest policy marks a clear signal that the Trump administration is prioritising domestic economic revitalisation, especially manufacturing and middle-class job creation, over globalisation and international diplomacy. But while this protectionist agenda may appeal to parts of the domestic electorate, its ripple effects could be significant.

Trade War or Trade Negotiation?

At the heart of these tariffs lies a broader goal: to rebalance the global trading system in favour of ‘Main Street America’. The Trump administration points to decades of industrial decline, rising inequality, and the erosion of domestic manufacturing jobs as the core justification for this new phase of economic nationalism. Since the late 1990s, the US has lost more than 90,000 factories and millions of manufacturing jobs.

Trump’s strategy, however, brings enormous uncertainty. And uncertainty – not necessarily bad news itself – is what causes market volatility. The possibility of retaliatory tariffs looms large. While Treasury Secretary Scott Bessent has encouraged other nations not to escalate, the world now stands at a crossroads: either negotiate with the US or retaliate. China has already responded with 34% reciprocal tariffs on US imports.

Whilst this uncertainty is contributing to heightened volatility across financial markets, it’s important to remember that the stock market is forward-looking. It reacts not to the news itself, but to whether that news is better or worse than expected. Simply put, prices move based on surprises.

In this case, if the announced tariffs had been lighter than anticipated, markets might have rallied. But because the tariffs were more severe than expected, investors were caught off guard, prompting a sell-off as the market repriced stock valuations.

This is a crucial concept for investors to understand: current prices already reflect the market’s collective expectations. So although it’s what fills our news feeds and our dinner table discussions, it’s not today’s headlines that move markets — it’s how reality compares to what the market had anticipated. Over the next 12 to 18 months, the direction of the market will depend on whether future developments are better or worse than those expectations.

Portfolio Implications: Diversification Is More Important Than Ever

The short-term impact on investor portfolios has been notable, as US equities have been under pressure. The technology-heavy “Magnificent Seven” stocks, already down this year, have extended their losses as investors reassess growth expectations in a more protectionist environment. Defensive sectors such as utilities, consumer staples, and healthcare have held up relatively well, offering a cushion amid the broader sell-off.

Looking Beyond the US: Global Resilience

We think it’s very important for investors to note that not all regions have struggled. UK equities had performed notably well since the start of the year, with the FTSE All-Share starting the year very strongly before Thursday’s pull back – post Liberation Day, UK equities are only slightly down year to date. European equities had a similarly positive start to 2025, before Thursday’s news caused a pull back to a relatively flat -2% year to date.

Likewise, exposure to global markets, especially those less affected by US trade measures, has proven valuable. The dispersion in returns between regions underscores the case for diversified, multi-asset portfolios, that are built to weather geopolitical and macroeconomic turbulence.

Unfortunately, much of our media feeds, especially financial media, is dominated by US outlets, many of whom focus entirely on the US market. However, this does not accurately reflect our real-life portfolios which tend to be globally diversified, meaning that the impact on your portfolio is likely to be less than you might think based on the US centric headlines dominating our feeds thus far in 2025.

Therefore, our globally diversified approach to investment portfolios should make weathering this short-term noise easier.

A Practical Take: What Should You Do?

In short, Trump effectively initiated a trade war on Wednesday. While markets had anticipated this, the tariffs announced were higher than expected. As a result, markets responded negatively on Thursday by pricing in the risk of the further economic disruption that could be caused by these further tariffs over and above what was already expected.

But rather than panic, it’s important to understand what’s actually happening beneath the headlines.

As markets are forward-looking, they digest new information rapidly and adjust prices accordingly. When uncertainty rises, such as from trade tensions, investors demand a higher return to compensate for the increased risk. The only way this can happen is through falling prices.

Lower prices mean that even if future company profits are reduced, the potential return for investors will still be attractive. In fact, expected future returns have increased.

While the headlines focus on short-term losses, the real story is that long-term investors are being presented with more attractive entry points and better future return potential:

1. Prices have gone down. Expected returns have gone up.

2. All empirical evidence, and indeed history, tells us that investing in the stock market is the best thing a long-term investor can do. And investing in the stock market just got a lot more attractive, especially when compared with any other alternative.

3. The best way to benefit? Stay invested in a broad, globally diversified portfolio.

Don’t react to short-term noise, remember: lower prices today mean higher expected returns tomorrow. It’s not a time for fear, it’s a time to remain disciplined, invested, and stay focussed on your long-term goals (i.e. the real reason you are investing in the first place). As the billionaire investor Warren Buffett famously said, ‘the stock market is a device for transferring money from the impatient to the patient’.

Final Thoughts

While Trump’s return to office has brought disruption, it’s also a reminder that markets rarely move in a straight line. Investors should expect volatility, and accept that policy changes, especially ones of this magnitude, can have wide-ranging consequences.

By staying diversified, maintaining discipline, and focusing on long term goals rather than short term noise, investors are well positioned to weather this storm and emerge stronger on the other side.

It is also a good time to review your cash position. If you have significant amounts above your “cash ceiling”, then the current environment does appear to be an attractive entry point with expected returns now higher.

As always, we will continue monitoring developments and rebalancing where necessary to ensure your portfolio remains aligned with your long-term goals.

You may also find some of our recent articles useful, which contain some very useful lessons in the current environment:

Weathering the Storm: Why Recent Market Volatility Doesn’t Matter for Long-Term Investors.

Does Timing The Market Work? No, and Here’s 5 Reasons Why It Doesn’t.

We hope that this has eased any concerns and reassured you that you remain on track to achieve your financial and life goals, but if you would like to discuss anything further please do let us know – your Financial Planner at Abacus is here to help.

By Technical Team @ Abacus

Please keep in mind that, whilst we aim to update these articles periodically, the content could be subject to future rule changes. Always make sure to speak to a qualified professional to ensure you have the most up to date information and are taking regulated advice around your specific circumstances.