Financial planning offers clarity in the face of the complex and often conflicting priorities that come with living abroad.

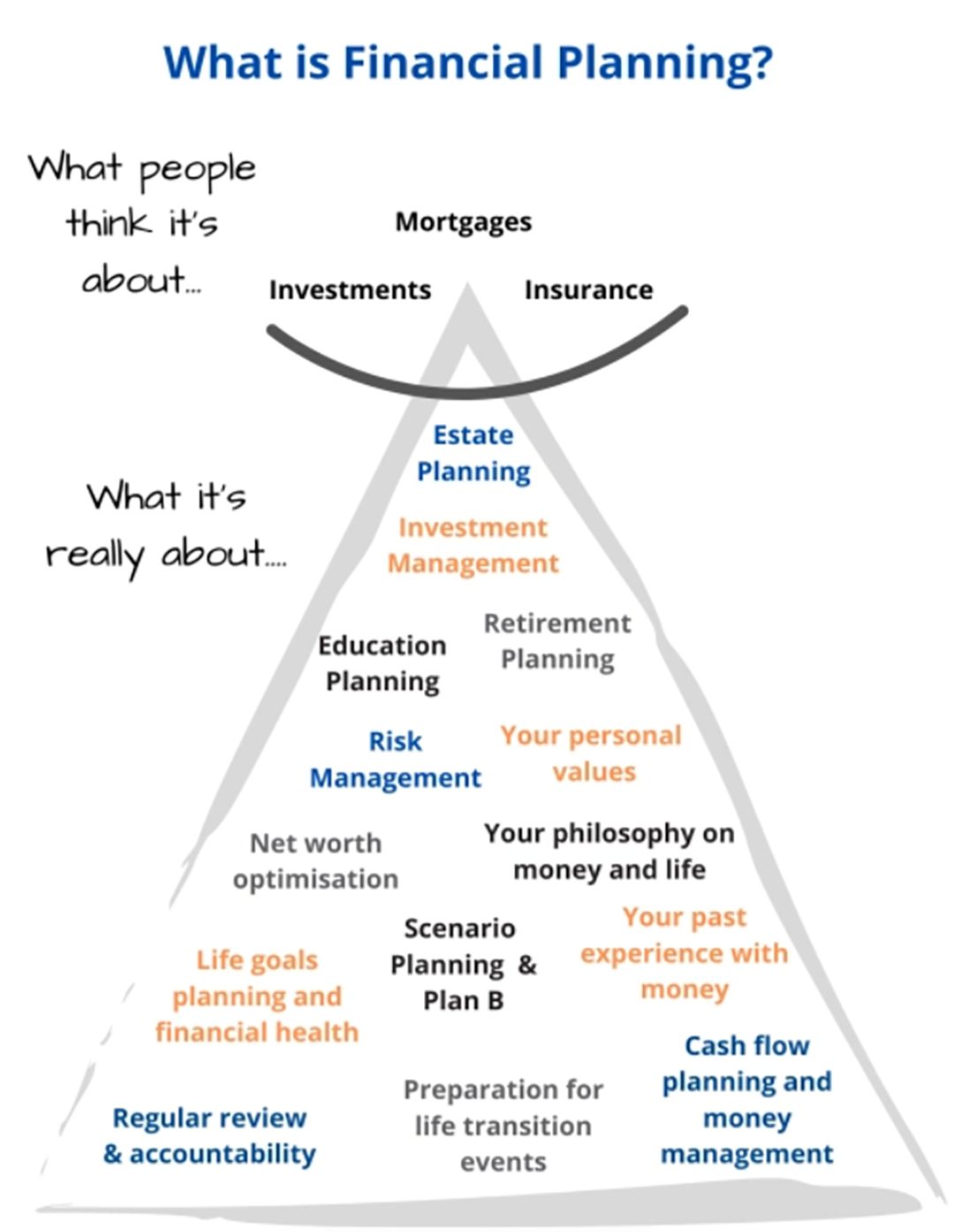

Many people think that “Financial Planning = investing”, but the reality is that investing is only a small subset of Financial Planning.

Financial planning is a holistic approach to managing your personal finances that involves defining your long-term goals, and then developing a strategy that aligns your assets, behaviour, and financial decisions to achieving them.

It’s much more than just investing – it’s about creating a comprehensive roadmap that aligns and co-ordinates every aspect of your financial life, from cash flow and budgeting, asset structuring and taxes, behavioural coaching and risk management, to retirement & estate planning.

Financial planning helps individuals and families prepare for both foreseeable and unforeseen life events, bringing structure, security, and confidence to the pursuit of financial independence.

Whether you partner with a professional Financial Planner or handle your own Financial Planning, here are 9 ways Financial Planning can benefit you.

1. Goal Setting – The Financial Planning Bedrock:

Any good plan should start with the end in mind.

Your Financial Plan is no different!

Building a comprehensive Financial Plan begins with defining clear, personalised goals. These can range from saving for retirement or buying a home, to funding education and leaving a legacy. By identifying what matters most, financial planning provides a structured path to achieving these aspirations.

Avoid setting arbitrary financial goals, such as aiming for a “$2,000,000 portfolio”, because financial goals rarely exist in isolation. Typically, there’s a deeper life goal driving that superficial target, and money is simply a tool to achieve those goals. For instance, a $2,000,000 portfolio might be what you need to fund your retirement – or it might not be. A good financial plan will help you determine the amount required to reach your real objectives. Before developing a financial plan, focus on identifying those true goals, so you can direct your efforts toward achieving what truly matters to you and your family.

2. Understanding Your Behaviour:

Understanding your income versus expenses is a critical foundation of Financial Planning.

It sounds simple, but ultimately, you will not see any progress towards financial independence if you cannot create a gap between income and expenditure!

We have worked with disciplined savers who, even on lower incomes, have retired with much larger nest eggs than individuals with higher incomes who did not balance saving for the future with discretionary spending. You need to understand how money flows in and out of your household’s “financial ecosystem”, and ensure your spending and savings habits are healthy.

From there, you can start to draft a plan for how you will allocate resources (money!) toward essential expenses, fun, short term savings (cash), and long-term savings (investments). This helps build a strong financial base that allows for continuous progress toward your longer-term goals.

3. Making Tax Optimal Choices:

Tax planning is vital to reduce your tax liabilities – both now and in the future – and maximise your after-tax wealth.

From an investing perspective, taxes can create a huge drag on the returns you achieve (or the value of your overall nest egg). A proper Financial Plan will develop a strategy for tax efficiency, not only in relation to making tax optimal investment decisions, but also around the use of tax advantaged accounts in which you should hold those investments – for example, ISAs, pensions, or investment bonds.

Beyond investing, this should also cover things like maximising any reliefs or allowances available to you, or putting in place a tax optimal drawdown strategy for your income in retirement.

4. Cash Flow Modelling – Visualising Your Financial Roadmap:

Cash flow modelling plays a critical role here and brings your Financial Plan to life.

Remember, an overarching Financial Plan is far more than a collection of investments – it shows you your financial trajectory and provides a dynamic roadmap to financial independence. Cash flow modelling is central to this, as it lets you simulate different scenarios and prepare for future expenses or life events with precision.

For example, your Financial Planner can use cash flow modelling to demonstrate the long-term impact of buying a property, projecting how this decision would affect your retirement savings, tax situation, and investment returns over time. This proactive approach helps ensure that every decision fits within your broader financial framework, providing clarity and consistency as your life evolves.

Overall, cash flow modelling can provide you with a brilliant framework for financial decision making, as it allows you to see how your current choices will impact your future outcomes – ensuring you stay on track!

5. Managing Risk and Protecting Your Family:

Living abroad without a familiar safety net can expose you and your family to unique risks.

Having a clear Financial Plan will not only give you peace of mind about your trajectory towards financial independence, but it will also allow you to identify potential shortfalls or risks that could halt your progress or blow you off course.

A Financial Planner will conduct a thorough risk assessment after your Financial Plan is in place, to ensure that you have the correct protections to safeguard your plan – such as insurance, wills, or trusts. These provisions can shield your loved ones from financial hardship and ensure your Financial Plan remains robust, even in the event of financial shocks or unforeseen circumstances.

6. Retirement Planning:

Many people see their retirement date as the end of their investing timelines, but that could not be farther from the truth. The reality is you will be an investor for your entire lifetime – whilst you will start to spend instead of save come retirement, the vast majority of your wealth will remain invested to sustain your retirement and fund your future spending.

Therefore, a crucial part to Financial Planning is building a retirement strategy to ensure your assets are sustainable and you can maintain your desired level of spending throughout your lifetime.

This includes asset allocation decisions heading into retirement, developing strategies around the order of your withdrawals to meet spending needs (for example withdrawing from an ISA vs a pension vs an investment bond), and maximising ways to supplement your retirement income with other guaranteed sources of income (such as any Defined Benefit pensions you might have, annuities, or State Pension).

7. Estate and Legacy Planning:

Planning for what you’ll leave behind is another crucial part of Financial Planning.

For a typical British family, c.£1,000,000 can usually be passed on to children free of UK Inheritance Tax (IHT), subject to owning a family home with the children as beneficiaries, with everything above that amount taxed at 40%.

Estate planning involves calculating your IHT exposure (both now and projected into the future), then developing a plan for how assets can be transferred to future generations in the most tax-efficient way possible.

It also ensures that your assets pass in line with your wishes: that the right people receive the right things, at the right times. This will usually involve setting up and maintaining wills, powers of attorney, or trusts. For an expat family, this could mean the added complexity of multiple wills in different jurisdictions, if assets are held in multiple countries (for example, a UAE will to cover a UAE property, and a UK will to cover UK assets).

IHT is often labelled the “voluntary tax”, because so few people plan for it and automatically fall into the tax net on death, while, at the same time, plenty of planning avenues exist to easily reduce your IHT exposure (or in some cases, remove it completely).

A professional Financial Planner can be invaluable for high-net-worth families who have concerns around estate planning and IHT.

8. Staying Compliant & Up To Date With Changing Regulations:

International tax laws and financial regulations frequently evolve.

And most expats usually have at least two jurisdictions to worry about – both their original home country and the country in which they currently reside (for example, the UAE & the UK).

Not only does this add more complexity, but it also typically creates a disconnect between you and your home country – for example, many British expats plan to retire back in the UK, but struggle to stay up to date with the tax regime and regulations given they do not currently live there or actively engage with it.

A Financial Planner helps you stay compliant and ensures your financial arrangements remain suitable. This is essential for expats with investments and assets in multiple countries or plans to relocate in future.

9. The Value of Professional Advice: Vanguard’s Adviser’s Alpha:

Research from Vanguard has demonstrated the quantifiable benefits of professional financial advice, showing that a well-structured plan and ongoing guidance can add approximately 3% to an investor’s net returns annually.

This added value, termed “Vanguard Adviser’s Alpha”, stems from several factors, including smart investment decisions, behavioural coaching, and effective tax strategies (particularly in retirement).

For expats, this professional guidance can be particularly valuable, especially when navigating tax liabilities in your home country or intended country(ies) of retirement/repatriation.

A financial planner who understands these complexities can create tax-optimised investment strategies, limit currency exposures, and ensure efficient portfolio rebalancing, all of which help to maximise your investment returns while reducing unnecessary costs or tax exposure.

Conclusion:

By combining investment decisions with clear goal setting, budgeting and behavioural coaching, tax optimisation choices, cash flow modelling, risk management, retirement planning, estate planning, and ongoing maintenance as life, finances, and regulations change, financial planning empowers you to make informed, forward-thinking financial decisions.

Financial planning offers the stability of a structured, adaptable plan that provides you with a clear path to achieving your financial goals, and helps you to confidently navigate life’s transitions along the way.

By working with a professional Financial Planner, they can act as a conduit or a soundboard for all things financial in your life, gaining an in-depth understanding of your unique financial and emotional landscape. As such, a Financial Planner is uniquely positioned to build a lasting, close relationship with you – offering ongoing support and personalised, impartial guidance as you navigate your way towards financial freedom and make important life and money decisions along the way.

By Technical Team @ Abacus

Please keep in mind that, whilst we aim to update these articles periodically, the content could be subject to future rule changes. Always make sure to speak to a qualified professional to ensure you have the most up to date information and are taking regulated advice around your specific circumstances.