As the weeks continue to pass, the impact of the pandemic takes us further and further into unchartered territory. Risk and return may not be joined at the hip anymore, with many governments increasing rescue measures and the definition of equity risk seemingly changing by the day. US oil is now priced negatively and that was the headline for one day only!

In a previous blog we discussed moving to cash and why inflation and market timing are two good reasons why that’s probably not such a good idea. In this blog, we look at diversification, which is a natural supplementary question when an investor is told to stay invested. In other words, I will stay invested but where should I be invested?

The answer is diversification. As hard as it is to time markets, it’s just as hard to pick sectors. You might, for example, see a headline about US oil prices and hope you don’t have any exposure in your portfolio, moving to change it if you do. This type of behaviour is more like trading than investing. Investing should be based on a long-term plan and your portfolio should be diversified with equity exposure linked to your tolerance to investment risk.

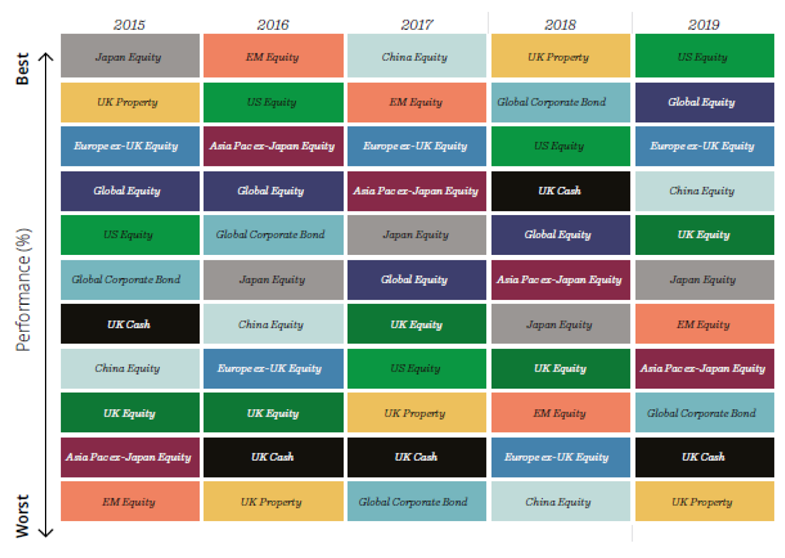

The graph below, reproduced with the kind permission of Quilter International, highlights the best and worst performing asset classes over the last 5 years. This illustrates the difficulty of picking winners. And this is not individual stocks, this is entire asset classes. The message here is clear, invest in the right asset classes for you, matched to risk and required return and hold the course.

You might make a claim that while the principle of diversification makes sense, we are currently living through unprecedented times. In other words, this time it’s different. Well, there are a number of historic events that have elicited a similar response.

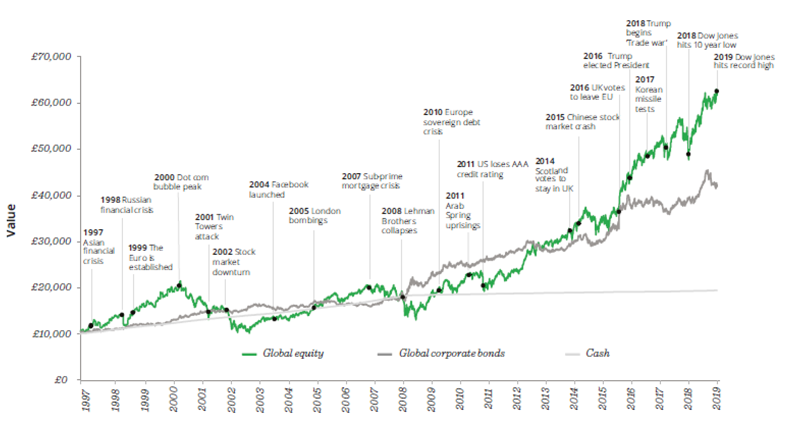

The graph below (again kindly supplied by Quilter International), plots a significant number of world events since December 1996, and the impact of retaining equities as a key diversifier. That impact would have seen £10,000 grow in excess of 500% when invested in global equities, through many events which were seen to be just as, if not more concerning at the time than present.

I’m sure many commentators used the phrase ‘unprecedented’ when each of the above events occurred. The current pandemic is a significant shock to the system and one that creates huge uncertainty for everyone. Staying invested in a diversified portfolio and remembering your overall investment goals is more important than ever right now.

If you have questions about the markets and the impact the pandemic has and might have on your investments in the future, you can talk to us. To book a consultation, simply follow the button below, enter some basic contact details and we will get back to you.

By Kay Pindoria

Executive Partner & Financial Consultant

O