You might remember Trump, tariffs, and “Liberation Day” impact dominating much of last quarter’s update.

In the second quarter of 2025, markets have been resilient and have – yet again – rewarded patient long term investors, having now fully recovered from the Liberation Day sell off in April.

US equities rose in Q2, with the S&P 500 up 10.15% across the quarter, no doubt aided by the Trump administration halting its tariff package for 90 days. Despite these gains, Q2 was a tumultuous period for US stocks – this period included a drawdown of -12% in April (post Liberation Day), before a recovery of almost +25% from the bottom of the market to the end of the quarter.

Overall, gains were led by the IT & technology sectors, as investor appetite for some of the “Magnificent 7” stocks reignited – these 7 stocks outpaced the index and delivered returns of 18.6% across Q2. AI stocks also staged a strong recovery after a weak start to the year.

Corporate earnings were also robust, which further aided US stock market performance across Q2.

President Trump unveiled his “big beautiful bill”, which was passed by the House of Representatives in June. The bill permanently extends the tax cuts passed in 2017 (which had been due to expire at the end of 2025) and introduces increases to defences spending and cuts to certain domestic spending programmes (Like Medicaid).

In the UK, equity markets rose in Q2 – the FTSE 100 delivered +1.46% while the FTSE 250 delivered +10.39%. The top performing sectors included industrials, telecommunications, utilities and real estate, while energy and healthcare lagged. The FTSE 250 index (which includes more mid cap exposure) outperformed the large cap FTSE 100 index, partly due to the latter’s higher exposure to these underperforming sectors.

Overall, volatility and uncertainty in other parts of the world (particularly the US and Middle East) likely aided the UK stock market, with investors seeing UK shares as a safer option.

In May, the Bank of England (BoE) cut interest rates by 0.25% to 4.25%. Inflation remains above the BoE’s 2% target, with a reading of 3.4% for May (according to the Office for National Statistics), but this move does indicate that institutions are confident that the rate of inflation is under control.

European equities also made strong gains in Q2 (up 10.77% in USD terms). Several European countries agreed to increase defence spending in the face of geopolitical concerns and ongoing tensions in the Middle East, Russia & Ukraine, leading to defence stocks continuing their strong performance.

European markets where the only region to provide positive market growth in Q1, so it’s positive to see this strong performance continue across Q2 – likely another indicator that investors are valuing diversification again and looking beyond the US.

With regards to interest rates, the European picture was also very positive. The European Central Bank (ECB) cut interest rates twice across Q2, by 0.25% on each occasion. Eurozone annual inflation was down to 1.9% in May, down from 2.2% in April (according to Eurostat data). With inflation dropping below the ECB target or 2%, ECB president Christine Lagarde suggested that the ECB had “nearly concluded” its interest rate cutting cycle.

Japanese equities also posted strong gains, with the TOPIX rising 7.18% and the Nikkei 225 rising 13.65%. Although the Liberation Day and “reciprocal” tariff announcements did trigger a decline in April, Japanese market sentiment improved across the quarter amid positive trade negotiation developments with China and other key trade partners, which eased recession fears and saw outperformance from growth stocks.

Corporate governance reforms in Japan have been an ongoing theme in our recent market updates, and this continued in Q2. With many Japanese companies releasing full-year results in Q2, shareholder returns through dividends and buybacks rose significantly, reflecting these ongoing reforms and supporting strong equity market performance.

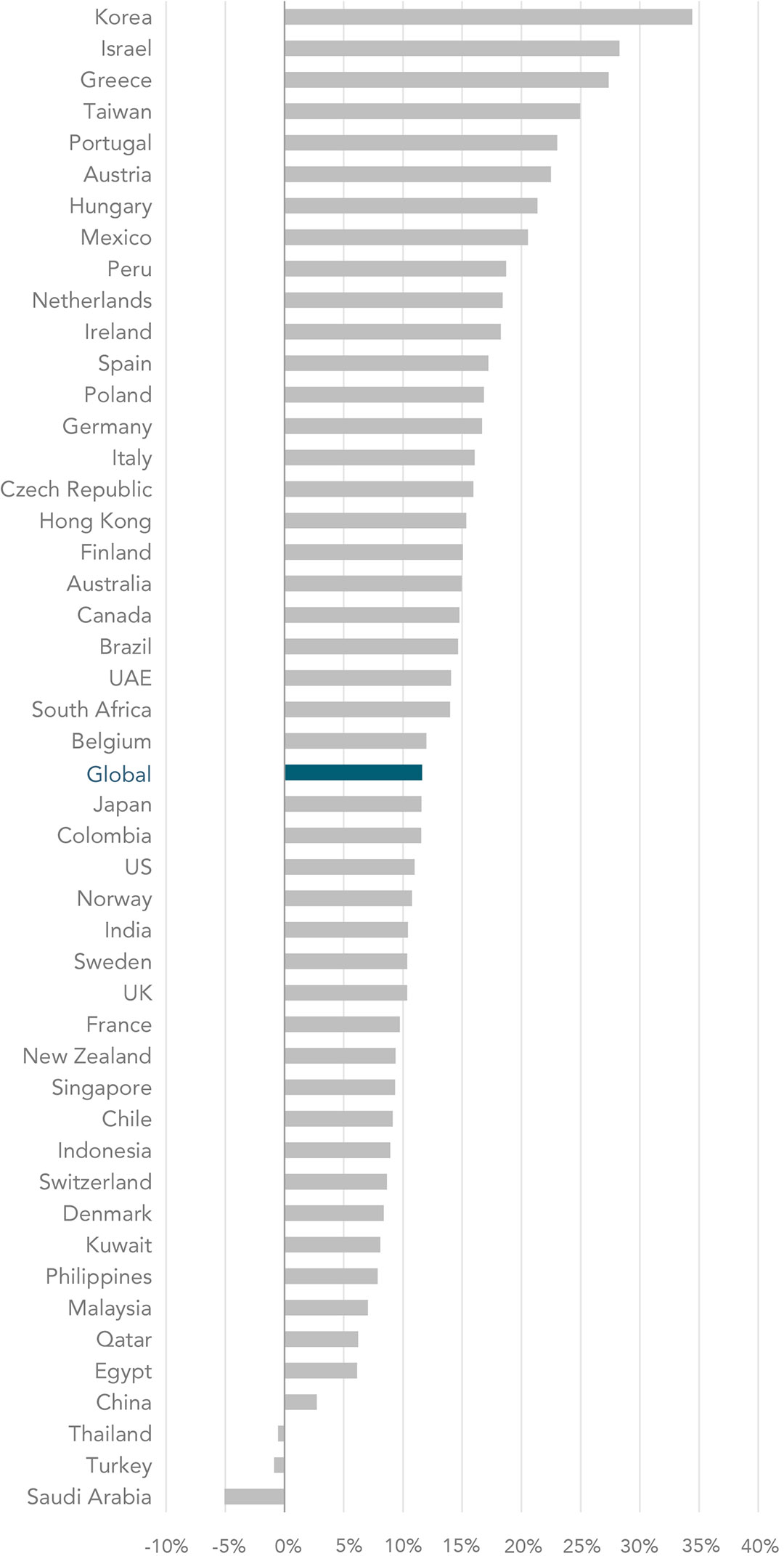

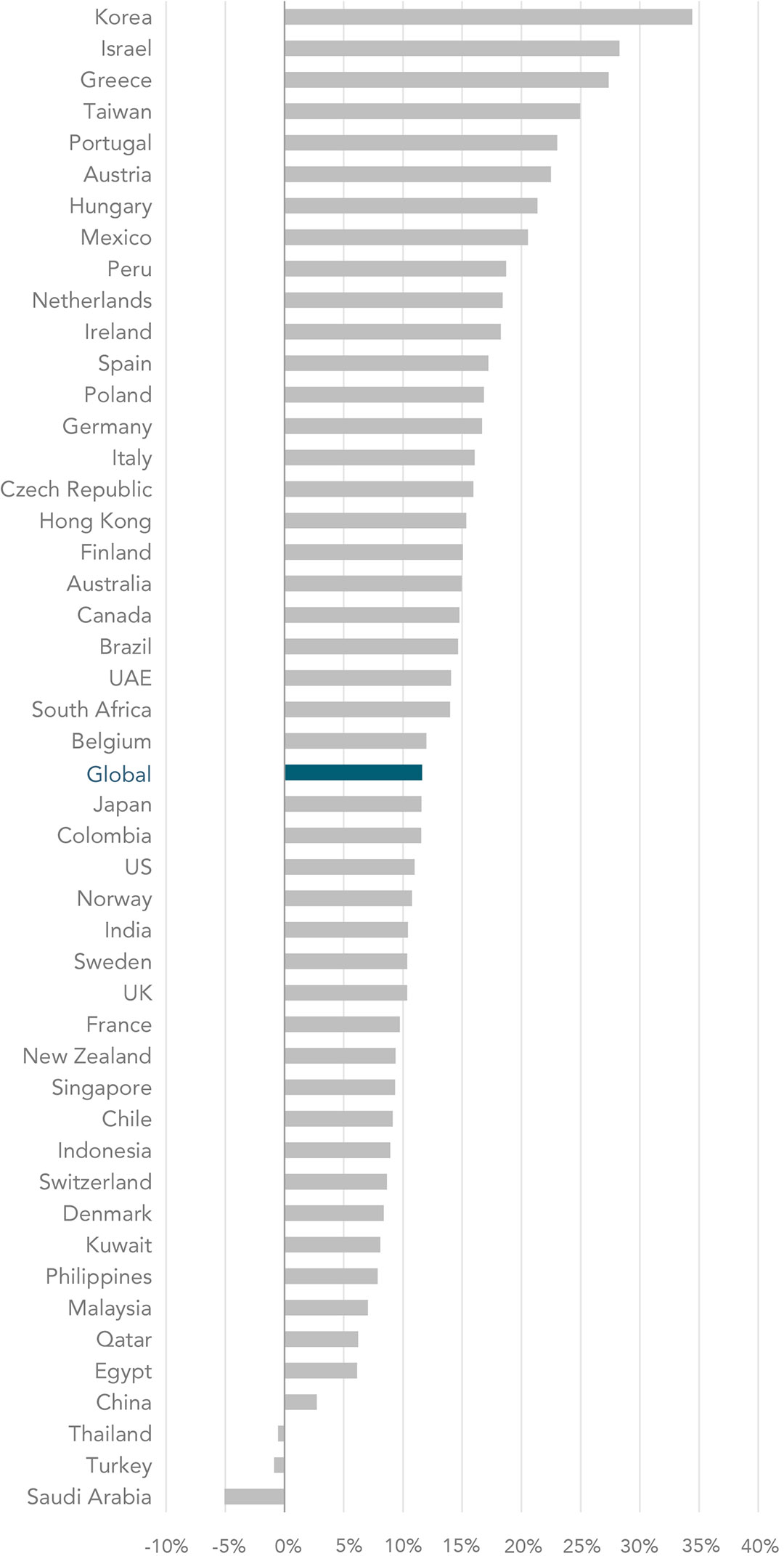

Source: Dimensional Fund Advisers

Across Asia, markets performed well, with a combination of easing trade tensions and the depreciating US dollar proving to be contributing factors to strong Asian equity market performance.

Korea, Taiwan and Hong Kong performed particularly well (improved sentiment towards AI and technology stocks helped here), while China and Thailand underperformed (with China receiving the worst of the escalating trade tensions with the US). These trade tensions did ease off across the quarter, but weak economic data in China continued to weigh on consumer sentiment, which kept Chinese equity market performance dampened across Q2.

Global Bond Markets were shaped by geopolitical tensions in Q2:

Q2 marked a shift in focus away from monetary policy (as central banks approach the end of rate cutting cycles) towards fiscal policy (and what this might mean for debt sustainability, particularly in the US).

Markets initially reacted to President Trump’s surprise “Liberation Day” tariff announcements in early April, which sparked recession fears. However, a 90-day suspension for negotiations, especially with China, helped ease market concerns.

Attention then turned to US debt sustainability, especially after the House passed the “Big Beautiful Bill” – a fiscal package that was seen to worsen the country’s debt dynamics. This led Moody’s to downgrade the US credit rating and US Treasury yields peaked.

Japan’s 30-year bond yield also reached a record 3.2%.

Central banks remained broadly dovish. The Bank of England and European Central Bank continued to cut rates modestly, while the Fed and Bank of Japan held steady. Yield curves steepened globally, with the Australian bond market outperforming amid softening inflation.

Credit markets showed resilience, supported by high yields and relatively low issuance. After widening in April post Liberation Day, credit spreads tightened again across Q2, returning to below pre-Liberation Day levels and marking an outperformance of government bonds overall.

Lastly, the US dollar weakened to a three-year low in June, pressured by trade policy uncertainty and relative fiscal strength abroad.

Conclusion:

Given the events that played out across Q2, the most useful thing we can do today is to simply reiterate our closing comments from our Q1 Market Update, written 3 months ago:

Q1 2025 reminded investors that while markets may not deliver blockbuster gains every quarter, progress doesn’t always come in a straight line.

Importantly, it reinforces a key point: short-term movements in markets are impossible to predict and are often driven by emotion or headlines. But over time, disciplined investors who stay the course and avoid reacting impulsively are consistently rewarded.

In terms of actionable steps investors can take in the face of volatility, we would highlight the below:

1) Revisit Your Financial Plan: Ensure your financial arrangements remain aligned with your short, medium, and long-term goals. Volatility is a useful reminder to check that your plan is still fit for purpose.

2) Review Asset Allocation and Risk Appetite: Take a moment to assess how you’re feeling about market fluctuations. On paper most investors want the highest return possible, but in reality, very few are comfortable living through the volatile periods required to capture that return. If recent movements have made you uneasy, you may be taking on more risk than is appropriate – perhaps you should look at adjusting your asset allocation accordingly, to a lower level of risk that will still generate enough return to achieve your goals. Conversely, if you’ve felt calm throughout, it might be worth considering whether increasing your exposure to growth assets could help you capture higher expected returns in future.

3) Check Your Cash Holdings Against Your “Cash Ceiling”: Reassess how much cash you’re holding versus how much you need – you should have a clear idea of how much cash you need to hold (i.e. enough to cover your Emergency Fund + any short-term goals you have over the next 0-5 years). However, it’s easy to let cash accumulate unnoticed. Volatile periods can be an ideal time to review this and reallocate excess cash into the market while valuations are lower and expected returns are higher.

Reading these comments 3 months later (and assuming you have taken our advice), you should now be a) very comfortable with your asset allocation and the risk levels of your portfolio, and b) one step closer to financial freedom having either maintained or increased your savings rate over the last 3 months and enjoyed supercharged returns.

As always, if you’d like to discuss how recent market developments affect your specific situation or financial goals, please do get in touch with your Abacus adviser.

Kind regards

The Abacus Investment Committee

Please keep in mind that, whilst we aim to update these articles periodically, the content could be subject to future rule changes. Always make sure to speak to a qualified professional to ensure you have the most up to date information and are taking regulated advice around your specific circumstances.