If you’re reading this, you are probably aware that we’ve been offering free consultations for concerned investors. The theme of these calls is often similar; stick or twist? Many investors want to know whether they should come out of the ‘market’ and head for the cover of cash or stay put.

While we witnessed historic falls in many markets around the world in the immediate aftermath of the pandemic, many have regained ground and stabilised, albeit at lower levels than before. Governments across the globe have been stepping in to help citizens and businesses, as a result of the need to lockdown and reduce the rate of infection. These interventions are significant and indeed in the US, the Fed is arguably becoming the largest player in equity markets there. World markets have been relatively flat in the last few weeks, as market participants try to make sense of what’s going on, much of which is unprecedented.

So, with all this uncertainty, should investors sell their holdings and move into cash. Well, the answer is no. Investors should stay invested. As the new popular saying goes, ‘don’t touch your face, or your portfolio!’ There are two primary reasons why investors should stay where they are; inflation and market timing.

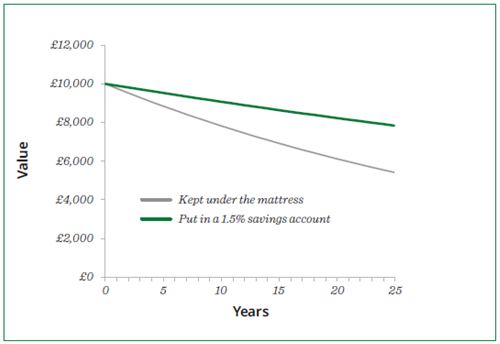

If you were to sell out of your investments and move to cash, the rate of inflation is likely to erode the purchasing power of your money. The graph below, reproduced with the kind permission of Quilter International, highlights what happens to the purchasing power of £10,000 over 25 years, when subjected to a rate of 2.5% pa inflation. £10,000 becomes £5,394, so the value of your money goes backwards if it’s not invested in something that produces a return above inflation (like cash).

But what happens if you’re invested in something that should be returning more than inflation but currently isn’t, because the markets are falling. Well, investing is a marathon not a sprint and while it can be difficult to control one’s emotional reaction to falling markets, the impact is only a paper one, unless you come out of the market.

The graph below (again, thanks to Quilter International), shows what would have happened had one invested £10,000 over 20 years to 31st December 2019, and missed just some of the best days in the UK equity market. We don’t know when the market will fall or rise, but if we are out of the market, we definitely won’t benefit from the upside. The impact is significant, with a return of more than treble if one stayed in the market vs missing the best 25 days of growth.

There were good reasons why you were invested in equity markets in the first place. At times like these, it’s very important to remember your goal and timeline and to resist selling equities for cash. You are statistically likely to go backwards in real terms while in cash and statistically unlikely to time your re-entry perfectly.

By Kay Pindoria

Executive Partner & Financial Consultant

O

0