For high-net-worth individuals, access to exclusive investment opportunities can be both a privilege and a temptation. Hedge funds, private equity, venture capital, real estate funds, and commodities are all marketed as “essential” components of a sophisticated investor’s portfolio (particularly in the international arena). But are these so-called “alternative investments” necessary to achieve financial success?

At its core, successful investing does not require complexity. In fact, the best portfolios often focus on simplicity, discipline, and a clear investment philosophy.

Just because you can invest in alternative assets doesn’t mean you should. Here’s why.

The Allure of Alternative Investments

Alternative investments are often associated with exclusivity and prestige. Many of these asset classes require significant capital commitments, long lock-up periods, and access to networks unavailable to everyday investors.

As a result, they carry a certain cachet – signalling wealth, sophistication, and access to opportunities that the average investor simply cannot tap into.

Additionally, promoters of alternative investments argue that they offer diversification benefits, uncorrelated returns, and higher potential gains compared to traditional assets like stocks, bonds or real estate. However, these claims don’t always hold up under scrutiny.

Do Alternative Investments Improve Portfolio Returns?

Many wealthy individuals delay or neglect estate planning, assuming they either have plenty of time, or that their heirs will be able to handle everything smoothly. This can lead to significant tax liabilities, family disputes, and a loss of control over how wealth is distributed.

While alternative assets have the potential for outsized returns, they often come with increased risk, higher fees, and less transparency. Let’s examine some of the most common types:

1. Hedge Funds

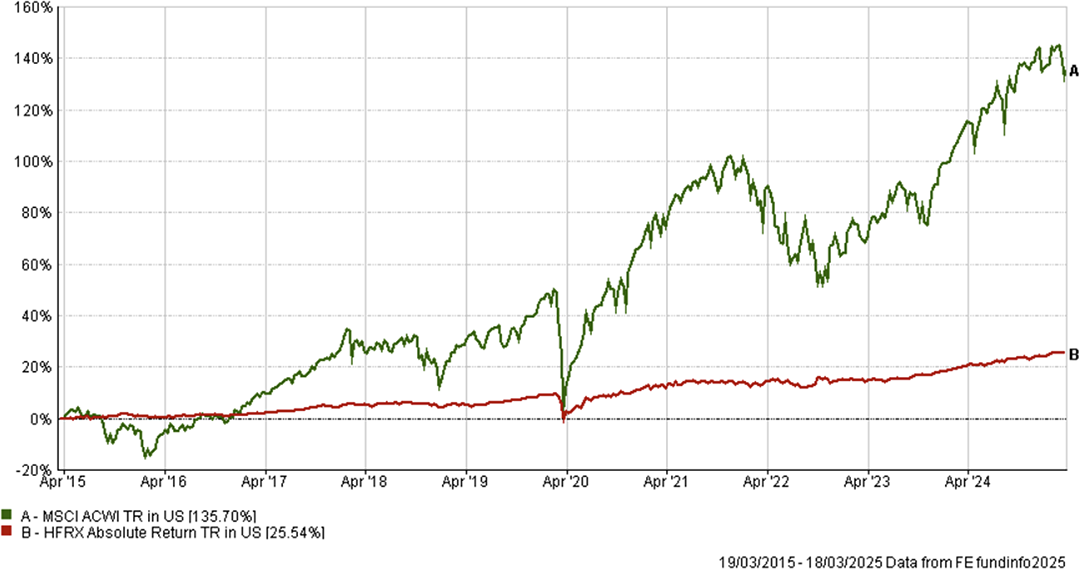

Many hedge funds promise market-beating returns through complex strategies, including leverage, short-selling, and options trading. However, research shows that after fees – often 2% per annum + 20% of profits – most hedge funds underperform simple, low-cost, stock/bond portfolios over the long term. The failure of many hedge funds to justify their high costs raises the question: are they truly adding value? To give some indication, below is the performance of the HFRX Absolute Return Index (designed to represent the overall composition of the hedge fund universe) vs the MSCI All Country World Index (designed to represent the overall composition of the global stock market):

2. Private Equity and Venture Capital

Private equity and venture capital funds have historically generated strong returns, but they come with high risks, illiquidity, and long investment horizons (it’s common for investors to have no access to their capital for 10+ years).

It can also be hard to access private markets, and the costs involved with doing so usually erode the potential benefits.

Additionally, success is heavily dependent on selecting the right fund managers, an area where even institutional investors struggle.

For most individuals, replicating market returns through publicly traded equities is a far more efficient strategy that delivers better investor outcomes.

3. Real Estate Funds

Investing in real estate can be sensible, but achieving diversification can be difficult/impossible for most investors – this is where real estate funds come into play.

Large private real estate funds often charge high fees and have limited liquidity. As well as that, publicly traded Real Estate Investment Trusts (REITs) usually offer similar diversified exposure to real estate as an asset class, with lower costs and greater flexibility.

4. Commodities and Collectibles

Gold, silver, art, wine, and other collectibles can sometimes serve as store-of-value assets, but their investment case is very weak when compared to productive income generating assets, like stocks (which generate profits, paid out as dividends) or real estate (which generates rental income).

Their value is largely speculative, and they generate no cash flow. While they may hedge against inflation, this will largely be based on “Greater Fool Theory” (i.e. someone must come along and simply agree to pay more for it than you originally did), rather than on any fundamental valuation of future cash flows or expected return.

Crucially, this lack of income means that they do not compound wealth in the same way that equities do.

The Simplicity of an Optimised Portfolio

A well-constructed portfolio does not need exotic investments to succeed. The fundamental principles of wealth building remain unchanged:

1. Own a Broadly Diversified Portfolio of Stocks and Bonds – Equities offer long-term growth, while bonds provide stability. A well-diversified global portfolio spreads risk across industries and geographies, managing risk and delivering robust & reliable returns.

2. Minimise Costs – High fees can significantly erode investment returns. Exotic, high-fee investment products – even when based on a legitimate idea (which is often debatable) – tend to see any advertised “pre-fee” advantage or excess return wiped out by their high costs.

3. Stay Disciplined – Market timing and chasing trends lead to underperformance. Building a solid Financial Plan & sticking to a clear investment strategy – regardless of short-term noise – is the best way to compound wealth over decades.

4. Maintain Liquidity and Flexibility – Locking up capital in long-term, illiquid investments can be a disadvantage, particularly if market conditions or personal circumstances change. Having access to liquid assets allows for greater financial flexibility. Although, as an investor, your aim is to keep money invested for as long as possible, you should always have the ability to access your own money if you should so wish.

Do Alternatives Offer True Diversification?

One of the strongest arguments for alternative investments is diversification. In theory, adding uncorrelated assets should reduce overall portfolio volatility. However, alternative investments often prove more correlated than expected during times of financial stress.

For example, during the 2008 financial crisis, many hedge funds and private equity investments suffered significant losses alongside the stock market. Additionally, the illiquidity of these assets can become a major issue when investors want to either access or re-allocate their capital.

Instead of seeking alternatives for diversification, a well-balanced portfolio can achieve the same goal and achieve near-perfect levels of diversification with a sensible mix of stocks, bonds, real estate and cash. Factor investing, which involves tilting towards value stocks, small-cap stocks, and other systematic drivers of return, can also enhance diversification without the drawbacks of illiquid investments.

For the vast majority of investors, alternatives are an unnecessary distraction from a well-constructed portfolio.

Conclusion:

Don’t let complexity undermine your financial future.

Having access to sophisticated investments does not mean they are essential for achieving financial success. The allure of exclusivity and complexity can lead high-net-worth investors to overcomplicate their portfolios, often to their detriment (many industry professional refer to some alternatives as “access classes, not asset classes” for this very reason).

Simplicity remains the foundation of effective investing. A clear Financial Plan underpinned by a globally diversified portfolio of stocks and bonds – coupled with good investor behaviour – remains the most reliable way to build and preserve wealth.

So before adding alternatives to your portfolio, ask yourself: are they truly enhancing your investment strategy, or are they just adding unnecessary cost, risk and complexity? Is this legitimately improving your portfolio, or does it just feel nice to access an “investment” most people can’t?

If you’re looking for expert financial guidance on optimising your portfolio, our team can help you build a strategy tailored to your goals – without the distractions of unnecessary complexity. Let’s focus on what truly matters: long-term, sustainable wealth creation and living your life free from financial worry.

By Technical Team @ Abacus

Please keep in mind that, whilst we aim to update these articles periodically, the content could be subject to future rule changes. Always make sure to speak to a qualified professional to ensure you have the most up to date information and are taking regulated advice around your specific circumstances.