Executive summary

• Risk assets ended 2025 on a constructive note. Global equities posted steady gains in Q4 and many major indices finished the year near record or multi‑year highs.

• Leadership broadened: non‑US equities outperformed the US market over the full year, helped by a weaker US dollar, relatively attractive valuations outside the US, and some rotation away from US technology stocks.

• Policy expectations remained supportive. Easing inflation pressures and expectations for further (moderate) rate cuts in 2026 underpinned sentiment.

• Bond markets diverged by region. UK gilts outperformed, US Treasuries delivered more muted returns, and Japanese government bonds sold off as yields rose sharply.

• Commodities were led by precious metals, while energy lagged. Digital assets experienced a volatile quarter with notable ETP outflows and a sharp retracement in Bitcoin from early‑October highs.

Global Equities

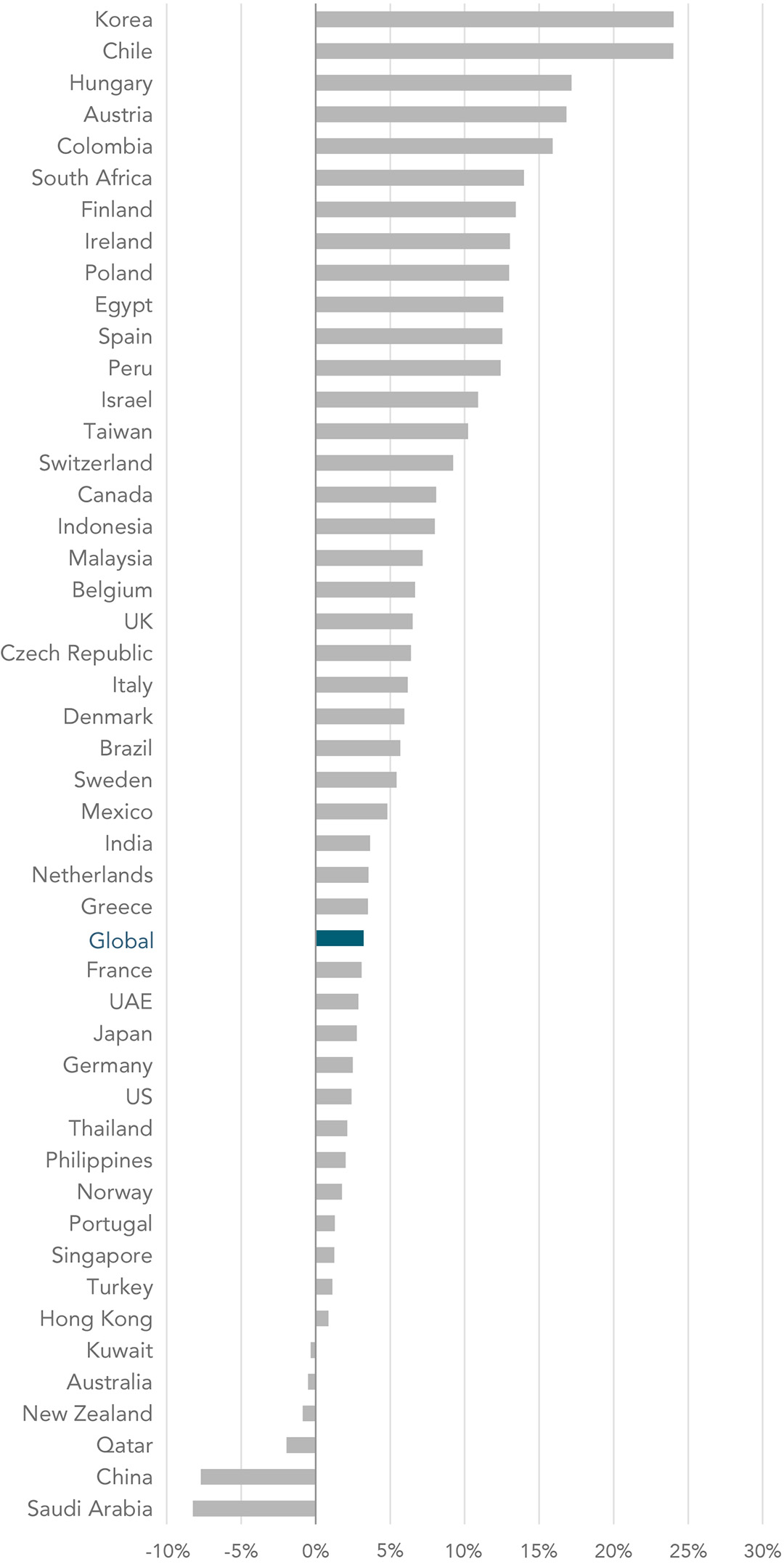

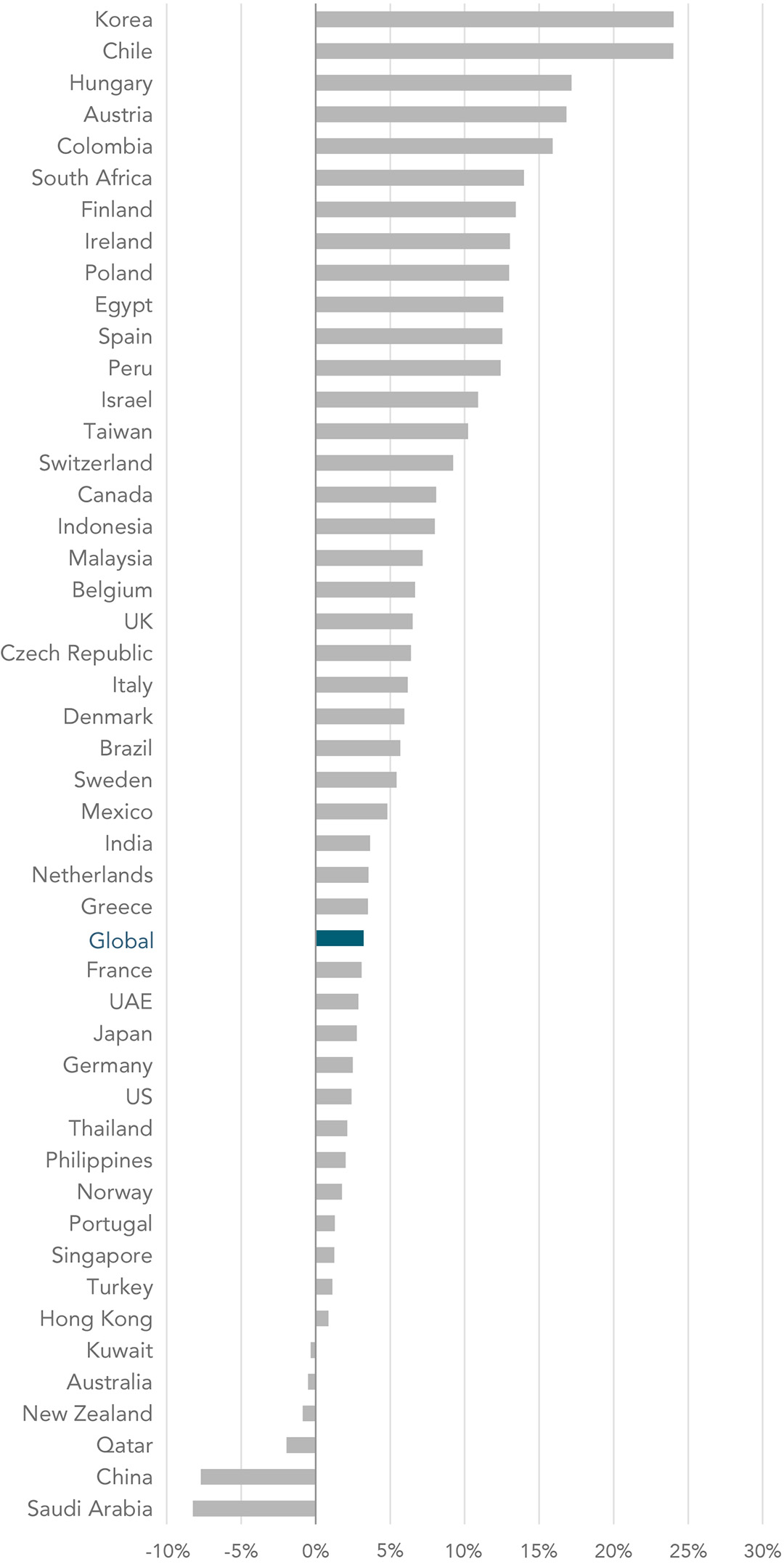

Global equities delivered modest but positive performance in Q4. For 2025 as a whole, the MSCI World Index (23 developed markets) returned 21% in US dollar terms. While enthusiasm around artificial intelligence (AI) remained an important driver, late‑year market breadth improved as value‑tilted and international markets attracted interest on the back of lower valuations and improving fundamentals.

Regional Highlights

United States

US equities rose in Q4 and recorded a third consecutive year of double-digit gains, supported by resilient earnings and ongoing enthusiasm around AI related business investment. Sector leadership remained most pronounced in areas with the greatest technology exposure, particularly Communication Services and Information Technology. Although performance broadened at points into more cyclical and defensive parts of the market.

In addition, monetary policy shifted toward easing in late 2025, with the Fed cutting rates on September 17, October 29 and December 10, 2025 — supportive for risk assets, but also a reminder that macro conditions can change quickly if inflation or growth surprises.

Eurozone

Eurozone shares were resilient into year end and outperformed US equities over 2025, helped by improving sentiment and strong performance from sectors such as financials, healthcare and utilities. The broader context for investors is that growth expectations stabilised, and policy settings increasingly reflected a lower inflation, lower rate direction compared with the prior tightening cycle.

For investors, the main watchpoints are whether earnings strength persists outside a handful of leaders, and how quickly easier financial conditions translate into broader activity. It is also worth remembering that euro-based equity returns for UAE investors can be materially influenced by EUR/USD moves, so currency exposure should be intentional (hedged or unhedged by design) rather than accidental.

United Kingdom

UK equities built on earlier gains, led by the large, globally exposed companies, notably in financials, mining, defence and other commodity linked area. Domestic-exposed firms can lag when household demand is under pressure, meaning index performance may not reflect the experience of more UK-centric businesses.

Investor considerations include the UK market’s structural bias toward international revenues and dividends, which can be a benefit when global growth is steady, but can also increase sensitivity to commodity cycles and global risk sentiment.

Source: Dimensional Fund Advisers

Japan

Japanese equities extended their rally in Q4 amid continued optimism around AI linked demand and improving sentiment, while late quarter volatility picked up as valuation concerns resurfaced. This pattern strong momentum followed by sharper swings is consistent with a market where expectations have risen quickly and investors are increasingly selective.

For investors, two practical additions are currency and policy: JPY moves can dominate USD-based outcomes, and Bank of Japan policy shifts (or market expectations of them) can change the cost of capital and equity multiples quickly.

Emerging Markets and Asia ex-Japan

Emerging markets outperformed developed peers, with the MSCI EM Index delivering double-digit returns. China, Taiwan, and Korea benefited from AI linked demand and easing US-China trade tensions. Markets such as Egypt and South Africa also performed strongly, supported by higher precious metal prices. Meanwhile, India and parts of ASEAN underperformed, constrained by tariff headwinds and softer domestic demand. Across Asia ex Japan, technology focused economies such as Korea and Taiwan dominated gains, supported by robust capital inflows and resilient export activity.

Asia ex-Japan

Asia ex-Japan rose in Q4, supported by technology and semiconductor themes in North Asia. Several Southeast Asian markets advanced on resilient domestic demand, while others were more muted amid softer external demand and ongoing trade uncertainty—reinforcing that “Asia ex-Japan” is not a single cycle.

Fixed Income Markets

Government bond returns varied meaningfully by market in Q4. UK gilts were a notable outperformer after a well‑received November Budget and a 25bp Bank of England interest rate cut in December (a close 5–4 vote). In the US, returns were more muted: the yield curve steepened as longer‑dated yields rose while shorter‑dated yields fell, following Federal Reserve cuts in October and December that took the federal funds rate to 3.5%–3.75%. Japan moved the other way, with a significant sell‑off in government bonds and yields reaching multi‑decade highs alongside a 25bp Bank of Japan interest rate hike in December to 0.75%.

Within credit, investment‑grade total returns were positive. After an early widening linked to concerns around non‑bank financial institution exposure, US credit spreads later compressed, leaving excess returns over government bonds broadly flat. Euro and sterling investment‑grade credit outperformed government bonds over the period.

Commodities and Digital Assets

Precious metals were the standout performers across commodities in 2025. Gold rose by more than 60% and silver gained more than 140%, supported by safe‑haven demand, a weaker US dollar, geopolitical uncertainty and moderating (but still elevated) inflation. Industrial metals also performed strongly: copper reached record highs on supply constraints and electrification‑linked demand, while lithium ended the year higher amid continued growth in battery and electric‑vehicle demand.

Energy underperformed. Oil prices fell through the year, with West Texas Intermediate ending 2025 at US$57 per barrel (nearly a 20% annual decline), reflecting oversupply and softer demand growth.

Digital assets saw a sharp rise and pullback during the quarter. The period began with strong October inflows into crypto exchange‑traded products (ETPs), followed by around US$3.0 billion of net ETP outflows in November. Bitcoin peaked above US$126,000 in early October but was trading around US$87,000 at 31 December.

Looking Ahead – Key Theme to Monitor Into 2026

• Inflation and central‑bank policy: expectations for further (moderate) easing in 2026 remain a key support for risk assets, but outcomes will depend on inflation and growth trends.

• Market breadth and valuation discipline: late‑2025 showed signs of a broader equity advance beyond a narrow set of large technology names; valuation sensitivity—particularly in technology and AI‑linked areas—remains important.

• Regional divergence: differences in growth momentum, fiscal policy and rate paths are driving dispersion across both equities and bonds.

• Geopolitics and policy uncertainty: tariff headlines and wider geopolitical developments remained a source of volatility in late‑2025.

• Commodity supply/demand balance: the source highlights divergent dynamics across precious metals, industrial metals and energy, with potential implications for inflation and resource‑linked equities.

Conclusion:

After consecutive years of growth in global equities, naturally, one considers whether the market cycle is at a point of correction. This could very well be the case, but much of the sentiment in current markets was prevalent at this very point in 2025, which then returned a positive year in global equity markets.

At times like this, and conversely, at times when markets have experienced corrections, the key is to remain focused on the planning as opposed to the underlying investment. With a broadly diversified portfolio, aligned to your risk profile, financial goals are met, but exiting or entering markets at various points within an investment time horizon very often result in weaker investment performance and increased worry.

The start of a calendar year is arguably the most common time that many people make changes in their lives in the form or resolutions, both personal and financial. If you feel that this resonates with you, then your Abacus Financial Planner is on hand to assist you with this, and where appropriate, help build a cashflow model aligned to your Financial Plan.

Kind regards

The Abacus Investment Committee

Please keep in mind that, whilst we aim to update these articles periodically, the content could be subject to future rule changes. Always make sure to speak to a qualified professional to ensure you have the most up to date information and are taking regulated advice around your specific circumstances.