A Reminder That Volatility Is Always Part of the Journey

Global Market Highlights:

After a buoyant 2024, the first quarter of 2025 provided a more muted start for investors, with markets around the world adjusting to the political and economic consequences of Donald Trump’s return to office.

US equities fell slightly in Q1, with the S&P 500 down -4.4% against the headwinds caused by escalating geopolitical tensions and questions around how Trump’s proposed tariffs and trade policies will unfold.

Technology and communication services were also impacted, as the news of China’s DeepSeek (a cheaper alternative to America’s AI market leaders) caused the market to re-evaluate future expectations for some of the largest US AI/tech names (such as Nvidia and the rest of the “Magnificent 7”).

Markets also reacted to ongoing signals from the Federal Reserve (the Fed), which held rates steady at 4.25% – 4.5% throughout Q1.

Despite inflation trending downwards in recent times, it is now sitting at 2.8% and very close to the Fed’s target rate of 2%, the Fed has increased its inflation outlook from 2.5% to 2.7% against the backdrop of tariffs and their potentially inflationary impact.

The Fed has also cut its growth forecast for the US economy for 2025, from 2.1% to 1.7%.

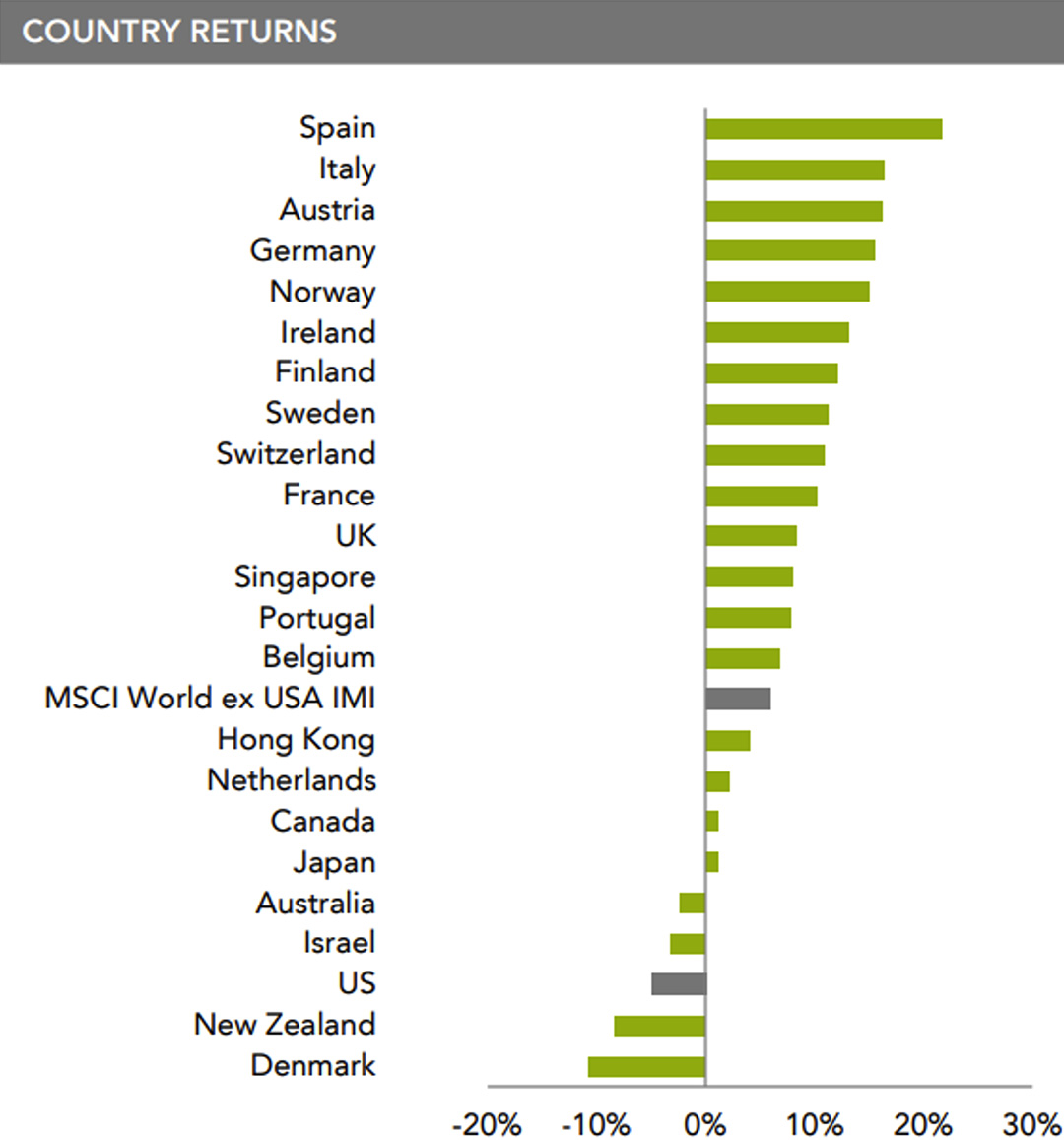

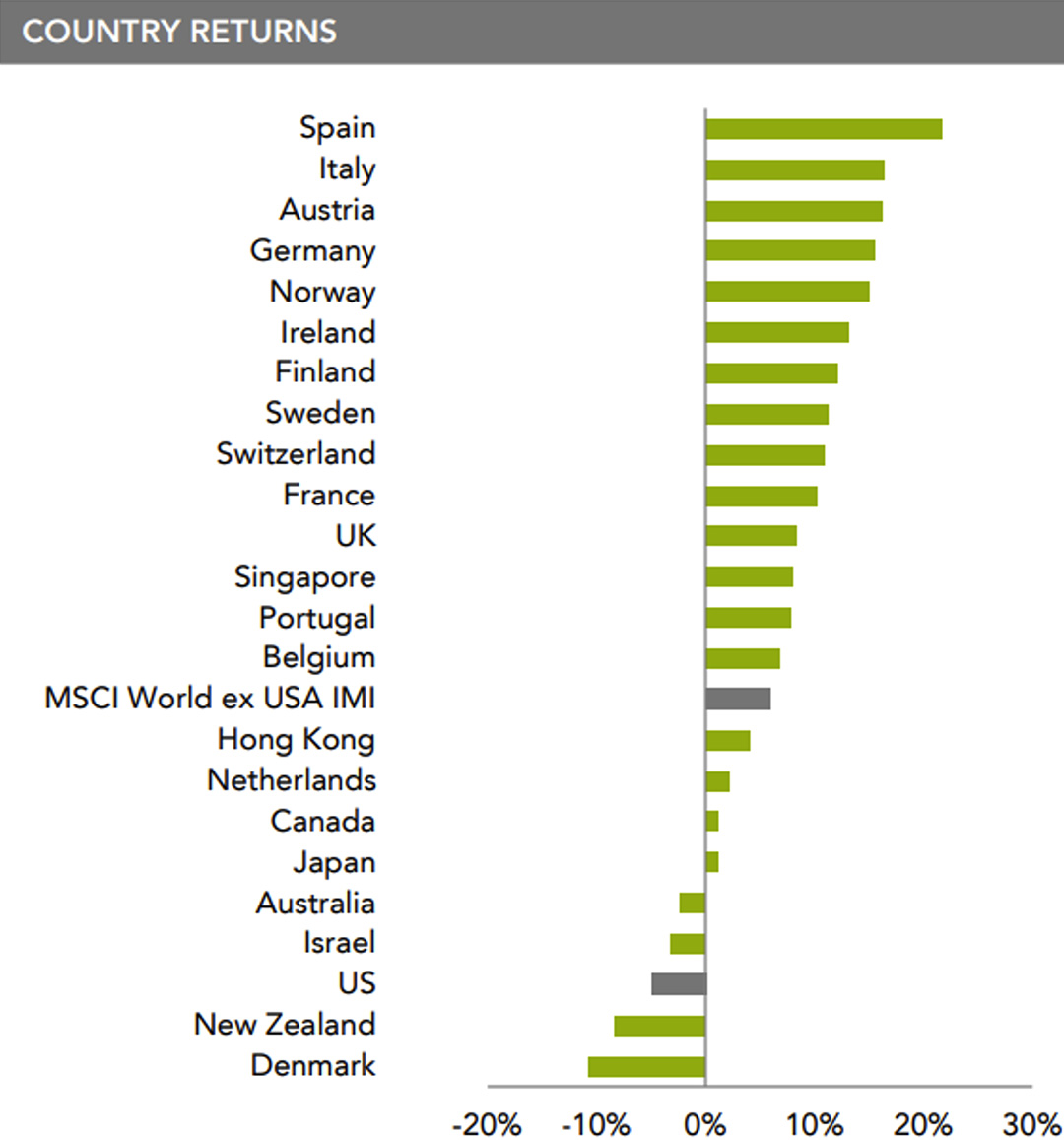

In the UK, equities rose, with the FTSE 100 gaining +9.4% over the quarter.

This was largely driven by larger UK companies, while smaller and mid-cap UK companies remained relatively fragile.

March’s Spring Budget, delivered by Chancellor Rachel Reeves, was the key talking point for UK markets. Despite speculation around further tax reforms – particularly around inheritance tax and pensions – the Budget mostly avoided major surprises.

The Chancellor reaffirmed her intention to maintain fiscal responsibility while also investing in public services and infrastructure. This provided some reassurance to markets, but did little to spark immediate excitement.

On a more positive note, UK inflation continued to edge closer to the Bank of England’s (BoE) target rate of 2%. By March, CPI inflation was around 2.6%.

In response, the BoE held rates steady at 4.5% in February and March, but reiterated that rate cuts are likely later this year if inflation continues to fall. This should bode well for both investors and borrowers over the coming months.

European equities started the year with a bang, with the MSCI Europe ex-UK index up +16.9% (in USD terms) in mid-March. However, the index pulled back after that, amid worries over the US imposing tariffs on imports from Europe. The index finished Q1 up +10.7%.

While falling inflation and interest rate expectations supported markets, political uncertainty, particularly in Germany and France, created some volatility.

Investors are also still digesting the potential ramifications of Trump’s trade policy proposals, particularly his rhetoric around European car tariffs and defence spending.

The inflation picture in Europe was a big positive, with Eurozone CPI falling to 2.2% in March and the European Central Bank (ECB) cutting interest rates twice in Q1. Interest rates now sit between 2.5% – 2.9%.

Japanese equities delivered returns of +1.33% in USD terms across Q1, but finished the quarter slightly in the red when viewed in yen terms.

Much like the rest of the world, the Japanese equity market faced downward pressure due to the uncertainty caused by the Trump administration and their tariff policy. The announcement of the 25% tariff at the end of March exasperated those fears, particularly the impact on the automative industry given the number of Japanese cars that are imported into the US.

On the positive side, the weak yen continued to support export-heavy companies, while optimism around corporate governance reforms and shareholder returns attracted fresh investor attention.

The Bank of Japan (BoJ) raised interest rates again for the first time since July 2024, reaching their highest point in almost two decades. Markets responded positively to this move, interpreting it as a sign of confidence in Japan’s economic recovery, though the BoJ did suggest that future interest rate hikes could be on the cards before they reach a point deemed neutral for the Japanese economy.

Q1 2025 Developed Market Returns (in USD):

Source: Dimensional Fund Advisers

Across Asia, markets beyond Japan also posted modest gains across the quarter, with the MSCI Asia ex-Japan Index rising +1.8%.

Chinese equities soared in Q1, off the back of AI developments and the release of DeepSeek’s lower cost open-source AI model in January. Chinese authorities also announced several new stimulus measures aimed at supporting consumption and easing credit conditions, which also helped the Chinese equity market.

The threat of increased US tariffs under Trump’s administration did weigh on sentiment towards the end of Q1, but the MSCI China Index still finished the quarter with gains of +15%.

Along with China, Singapore and South Korea also performed notably well, while Thailand, Taiwan and Indonesia were the laggers in the MSCI Asia ex-Japan Index over the quarter.

Global Bond Markets remained relatively stable over Q1.

In Q1 2025, global macroeconomic conditions shifted notably. The US saw a decline in sentiment and rising recession fears due to policy uncertainty, while Germany’s fiscal policy shift improved Europe’s outlook. Germany approved a major infrastructure fund and relaxed debt rules, triggering a sell-off in German Bunds and a surge in yields.

US Treasuries outperformed as weaker data drove yields lower. Canada also saw falling yields due to tariff concerns but underperformed the US. In corporate bonds, US dollar bonds outpaced euro bonds across both investment grade and high yield segments.

The UK faced stagflation risks and fiscal strain, pushing gilt yields slightly higher. In Asia, Japanese bond yields rose on strong GDP and inflation figures (leading to likely interest rate hikes), while China’s deflationary outlook kept yields stable.

Conclusion:

Q1 2025 reminded investors that while markets may not deliver blockbuster gains every quarter, progress doesn’t always come in a straight line.

Importantly, it reinforces a key point: short-term movements in markets are impossible to predict and are often driven by emotion or headlines. But over time, disciplined investors who stay the course and avoid reacting impulsively are consistently rewarded.

In terms of actionable steps investors can take in the face of volatility, we would highlight the below:

1) Revisit Your Financial Plan: Ensure your financial arrangements remain aligned with your short, medium, and long-term goals. Volatility is a useful reminder to check that your plan is still fit for purpose.

2) Review Asset Allocation and Risk Appetite: Take a moment to assess how you’re feeling about market fluctuations. On paper most investors want the highest return possible, but in reality, very few are comfortable living through the volatile periods required to capture that return. If recent movements have made you uneasy, you may be taking on more risk than is appropriate – perhaps you should look at adjusting your asset allocation accordingly, to a lower level of risk that will still generate enough return to achieve your goals. Conversely, if you’ve felt calm throughout, it might be worth considering whether increasing your exposure to growth assets could help you capture higher expected returns in future.

3) Check Your Cash Holdings Against Your “Cash Ceiling”: Reassess how much cash you’re holding versus how much you need – you should have a clear idea of how much cash you need to hold (i.e. enough to cover your Emergency Fund + any short-term goals you have over the next 0-5 years). However, it’s easy to let cash accumulate unnoticed. Volatile periods can be an ideal time to review this and reallocate excess cash into the market while valuations are lower and expected returns are higher.

Overall, Q1 – and President Trump’s first few months in office – highlight why having a robust financial plan and a well-diversified portfolio is so important. Whether you’re accumulating wealth, generating income in retirement, or planning for future goals – it’s your long-term strategy, not short-term market noise, that will determine your success.

As always, if you’d like to discuss how recent market developments affect your specific situation or financial goals, please do get in touch with your Abacus adviser.

Kind regards

The Abacus Investment Committee

Please keep in mind that, whilst we aim to update these articles periodically, the content could be subject to future rule changes. Always make sure to speak to a qualified professional to ensure you have the most up to date information and are taking regulated advice around your specific circumstances.