The world of investing can appear to be fast paced.

The image of the “investor” most people visualise is the Wall Street Trader.

The stock market news people read is both extreme (because that’s what attracts eyeballs) and short term (because headlines need to be printed every day).

Therefore, there is persistent temptation to attempt timing the market – the idea of buying low and selling high to maximise investment returns.

Getting in and out of the market at the right times is surely the best strategy?

Yet as enticing as it sounds, market timing is a recipe for disappointment, not success.

The recipe for success is quite the opposite – a disciplined, long-term approach to investing.

In this week’s blog we’ll run through 5 key reasons why trying to time the market does not work.

1. The Impact of Missing the Market’s Best Days

Significant market movements tend to happen quite quickly – often within the span of just a few days.

There is a famous Lenin quote in which he said, “There are decades where nothing happens; and there are weeks where decades happen”.

This translates well to the world of investing, where a commonly used reference is that just 10% of trading days typically drive 90% of the market’s overall return.

At the same time, many of the market’s best days often occur quite quickly after its worst days (i.e. during the periods when investors are most tempted to come out of the market).

For example, 5 of the top 10 days in the chart below occurred within a 6-week window during Q4 2008 (the Great Financial Crisis), while a further 3 of the top 10 days occurred in March & April 2020 (during the COVID pandemic).

If you try to time the market, you run the risk of missing the best days in the market – a mistake which will compound exponentially into the future.

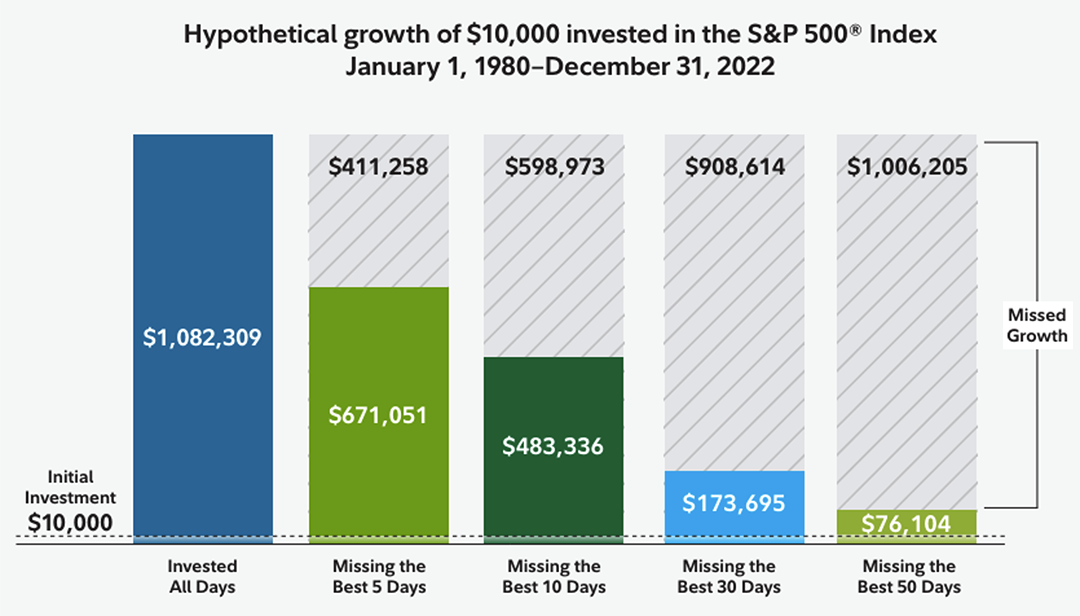

The chart below helps to illustrate this, showing the growth of $10,000 invested from 1980 – 2023. Had you stayed fully invested over the entire 40+ year period, $10,000 in 1980 would have grown to $1,082,309 by 2023.

However, had you missed just the 5 best days over the 40+ year period, you would only have $671,051 (i.e. a hit of -$411,258, which is over a third of the return).

Source: Fidelity Investments

2. Stocks Tend to Go Up.

Over the long term, stock markets relentlessly march forward.

If you stretch your time horizon out long enough, even the most extreme market crashes – the 1987 crash, the dot com bubble, the 2008 Great Financial Crisis, the COVID pandemic – all fade into meaningless background noise.

As such, waiting on the sidelines to time the market, usually means that your eventual entry point is higher than the starting point – even with perfect market timing.

Take the below chart as an example – which shows global stock market performance over the last 10 years.

US elections are often a trigger for people to attempt market timing, with Donald Trump’s election in 2016 proving to be a particularly popular time for speculation and attempted market timing.

Had you been worried about Trump’s election in 2016 and decided to “wait for a better time to invest”, when would you have entered the market?

Even if you had a crystal ball and could time the market perfectly (which is impossible), the next “trough” following Trump’s election (the first red dot) was during the darkest days of COVID in 2020 (the second red dot), yet markets were still +10% higher than on the day of Trump’s election win.

The moment market timers are waiting for rarely arrives, as markets – despite short term fluctuations – tend to trend upwards over time.

If you try to “wait for the dip”, while you are waiting, the market is likely to keep on rising and leave you behind.

3. Too Many Impossible Decisions to Make

Not only do you have to decide on when to come out of the market, you also have to decide on when to re-enter the market (for example, the two red dots in the chart above).

Thus successful market timing requires two impossible decisions to be made correctly, not just one.

The probability of you getting one of these decisions correct is minute, never mind two.

When you consider your long-term goals and your timelines, you will probably be alive – and thus an investor – for decades to come.

Therefore, successful market timing requires you to get these impossible decisions right not just twice, but twice consistently, every year, for the rest of your life.

As such, even if market timing could be done (which it can’t), it is not a sustainable long term investment strategy.

4. The 2 Faced “Cost of Delay” Coin – Heads: Compounding

Time & compound interest is the “two ingredient winning formula” for wealth creation.

The earlier you start investing, the more time your money has to snowball and grow exponentially.

The concept of compounding means that not only does your money grow, but the growth on your money also grows – this multiplier effect can lead to spectacular wealth accumulation if given the time for the math to work.

And the way that math works means that compounding becomes much stronger in the later years – to give you an example of that:

- A penny doubled every day for 20 days would give you just £5,242.88

- However, if left alone for just another 5 days, after 25 days it would give you £167,772.16 (just 5 more days creates an additional £162,000).

- And after 30 days it would give you £5,368,709.12 (just 10 more days creates an additional £5.3m!).

Therefore, there is a real cost of delay that runs far deeper than you might think – sitting on the sidelines waiting for “the right time” only presses pause on when this compounding effect starts, and shortens the window of time in which the effects of compounding have to work.

5. The 2 Faced “Cost of Delay” Coin – Tails: Inflation

While you’re missing out on all this compound growth, your cash will also be sat on the sidelines with inflation running rampant, eroding the real value of your money while you wait.

At the time of writing this article, UK inflation was 3.4%. So, £100 sat in the bank for the last 12 months is worth £96.6 today, in terms of its purchasing power and what you can actually buy with that money.

Think about leaving money in cash like leaving water in a leaky bucket – it’s going to drip away until you decide on what to do with it.

If you don’t need the money and you have identified it as long term savings that you won’t need for decades, don’t try to time the market – get that money invested and working for you as soon as possible.

Conclusion:

Market timing can be tempting, but is a strategy that is fraught with risks and impossible challenges.

The unpredictability of short-term market movements, coupled with emotional biases and the difficulty of consistently outguessing the market, make market timing a suboptimal approach to investing.

Instead, investors should adopt a disciplined, evidence based, long term investment strategy that has been established to align with their long-term objectives.

By focusing on factors within their control and staying invested through market fluctuations, investors can enhance their chances of achieving their financial goals over their lifetimes.

By Technical Team @ Abacus

Please keep in mind that, whilst we aim to update these articles periodically, the content could be subject to future rule changes. Always make sure to speak to a qualified professional to ensure you have the most up to date information and are taking regulated advice around your specific circumstances.