War and conflicts certainly bring tension. Even if you’re sat safe, thousands of miles away, they will dominate news headlines and many of our day-to-day conversations.

The tone of these conversations and the nature of war inevitably lead to higher anxiety levels amongst investors.

In recent years, we have certainly seen plenty of conflict, in particular the war in Ukraine and the Israel/Palestine situation.

As such, it certainly feels like a good time to examine how exactly markets behave during times of war and conflict, to provide you with peace of mind around how you can navigate these periods, and continue to manage, preserve, and grow your wealth.

The Key Takeaway – Markets are Resilient to War

This might come as a surprise to most people.

But the truth is, that whilst wars are huge geopolitical events that impact both the world and our lives in many ways, their impact on our investment portfolios are minimal.

In the case of most wars, there is actually little impact on the underlying fundamentals or the overall trajectory of the market. The mechanics of why this is can be complex, but some of the headline reasons are:

- Although it may sound counter intuitive, war tends to benefit the economy because demand for equipment and goods increases. Higher demand typically leads to higher prices (and we often see inflation off the back of this).

- A country’s defence budget can often be a significant portion of their GDP (the US being a good example here).

- Beyond the front line, life does largely go on as normal – people still go to work, socialise with their friends and families, and they keep spending money on food, transport, and all the goods and services provided by the companies within our investment portfolios (for example, the revenue produced by smart phones in Ukraine in 2023 was $1 billion, with 56% of this revenue coming from Apple, Samsung & Xiaomi).

- Markets are highly efficient information processing machines, and wars are often a result of tensions building up over time – i.e. they are not a surprise, so by the time forces actually engage, markets have already priced it in.

The Data – Historical Market Performance During Times of War

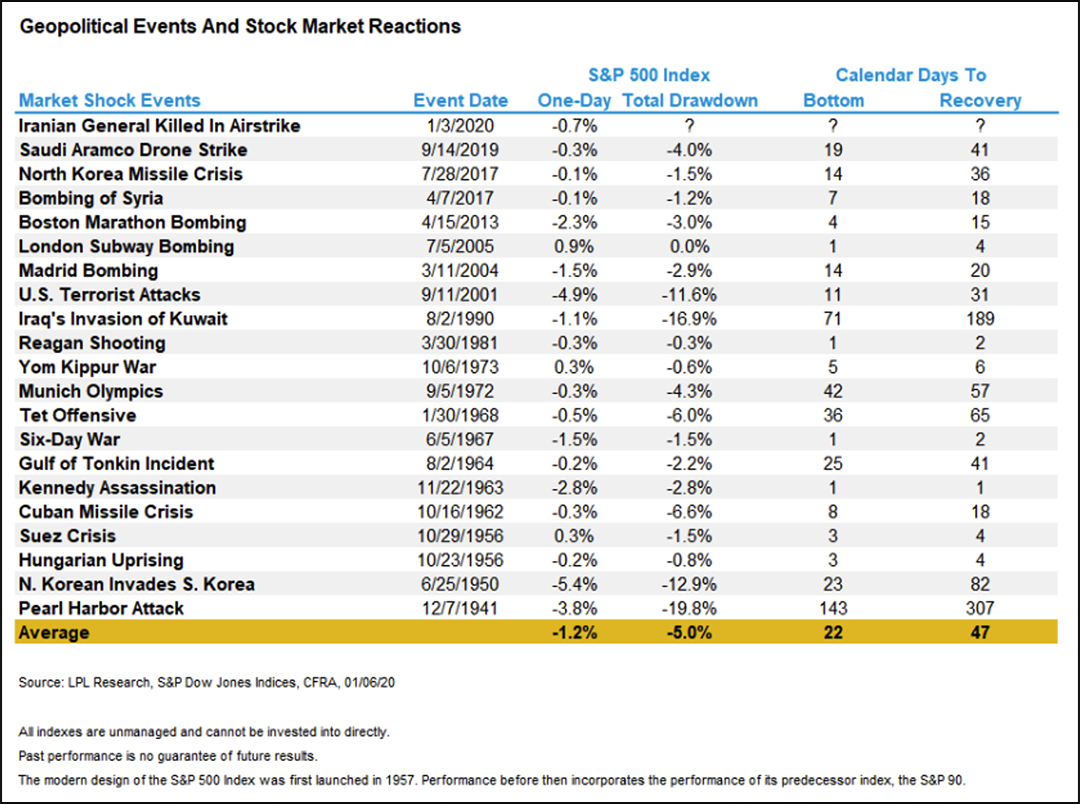

A 2020 study conducted by LPL Research (below) examined the impact of 21 major geopolitical events since 1941 – this study covered everything from terrorist attacks like 9/11 and the London bombings, to shock events that led to war like Pearl Harbor or the many Middle Eastern conflicts.

Despite the seriousness of all these events, the market reaction was mild at best – on average, falling by just 1.2% within the first day, and falling by a total of just 5% to the very bottom. From the day of the event, this “bottom” took just 22 days to reach and recovered fully within 47 days.

For long-term investors, short periods like this, of just over 1 month, are irrelevant – in fact, most sensible investors would not even notice this impact at all, as they will only log in to check their portfolios once every 3, 6, or even 12 months.

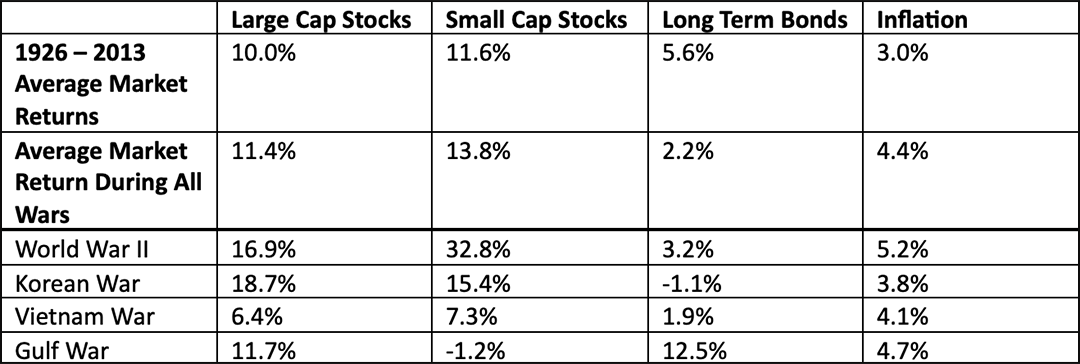

In a similar study carried out by the CFA Institute, they examined all major wars since 1926 and found that, in fact, stocks performed better than average during wars.

Interestingly, this holds true for both large cap and small cap stocks, while defensive assets like bonds performed below average. The key numbers from this dataset can be found below:

Of course, all wars are different, and markets will react differently, but the data does suggest that:

a) Wars are not necessarily bad for markets – in fact, they can be a positive.

b) War tends to be inflationary (making investing our hard-earned savings even more important).

So if War is not the enemy of markets, what is?

Uncertainty.

As mentioned earlier, markets are an information processing machine – i.e. this mechanism sets prices that reflect, in real time, all known information.

Therefore, the worst thing for markets is not war, geopolitics, or even natural disasters.

It is uncertainty.

Uncertainty creates volatility, because the market is trying to price assets, while at the same time, it is now reassessing new risks and is unsure about the outlook for the future.

This all happens live, so prices can fluctuate around as markets try to take in all available information, reassess the risks, establish an outlook for the future, and set a correct price.

Meanwhile, volatility in markets – especially when it is instigated by something as tense as war – typically leads to uncertainty and anxiety amongst investors, usually resulting in swarms of undisciplined investors moving their money out of stock markets and into more defensive assets, such as bonds, gold, or even cash (despite the data showing that this would be a mistake for long-term investors).

However, the market usually processes this information and prices in new risks very quickly, before returning its focus to market fundamentals, like growth and earnings.

So although the winds of conflict might blow on markets briefly, the market will typically reassess, price this in quickly, then move forward like it has always done.

Conclusion:

The future is unknowable and, like any reputable Financial Planning firm, we at Abacus do not believe it is possible to predict the future performance of any investment.

This remains true when it comes to any attempt to forecast how markets will react to wars and conflicts in the future.

However, the historical data suggests that, while uncertainty may create some short-term volatility, stock markets do not suffer during periods of war.

As a long-term investor, short term fluctuations in markets – whether triggered by conflicts or anything else – should not dictate your investment decisions. The highest probability of success can be found by investing in a globally diversified portfolio, in line with your risk tolerance, and remaining focused on your long-term goals.

By Technical Team @ Abacus

Please keep in mind that, whilst we aim to update these articles periodically, the content could be subject to future rule changes. Always make sure to speak to a qualified professional to ensure you have the most up to date information and are taking regulated advice around your specific circumstances.