Receiving a financial windfall can happen in many ways – some common examples are inheritance, large work-related bonuses, selling a business, or – for some lucky people – a lottery win!

Usually, this can be an exhilarating experience. However, it’s also crucial to approach this injection of wealth with careful consideration and well thought out planning – especially if it results in sudden wealth, i.e. you have gone from having not much wealth to a lot of wealth very quickly.

This article has been designed to help anyone who has received – or is expecting to receive – a financial windfall. Such events rarely happen more than once in life, so we’ll discuss 7 prudent steps you should take to safeguard your windfall and set yourself up for long term, sustainable success.

Step 1 – Pause, Breath, Reflect:

Take a breath.

Don’t do anything for a month or two.

Initially, receiving a windfall can result in a surge of dopamine – it’s exciting. However, it’s important not to let this take over your decision-making process.

By all means, enjoy the moment and celebrate.

But don’t rush into anything big – avoid making impulsive or extravagant purchases, and avoid any large financial commitments.

A large windfall is usually a once in a lifetime event, so if you squander this money, you won’t get it back again.

In the early days and weeks after receiving a windfall, it’s important to take some time to reflect on your newfound wealth.

Think about your life up until this point, and how it might change moving forwards:

- What are the areas in life you enjoy spending time?

- What are the areas in life you don’t?

- What are your core values?

- What are your aspirations for the future?

- Think about your goals broken down into 3 categories – short (this coming year), medium (1-5 years) and long term (5 years +).

- If your windfall has come from an inheritance, the excitement around it will be significantly diluted. However, it can be a useful exercise to think about the person from whom you have inherited – how would they want the money to be used and what would make them proud?

Reflect on how your windfall can align with all of this to maximise your overall personal and financial wellbeing.

Step 2 – Seek Professional Guidance:

Navigating a windfall can be overwhelming, especially if you’re not used to managing large sums of money.

Once you have reflected on your newfound wealth, and before you take any action with it, this can be a good time to consider seeking professional guidance from a Financial Planner or adviser.

They will be able to build on your reflections and work with you to develop a tailored Financial Plan, or a “financial roadmap” for the future. They can help you to manage your wealth effectively, avoid common pitfalls, and maximise your situation.

Take the below case study of John Smith as an example – John is in an average position but receives a windfall of £3,000,000 at age 45.

The key things John does after receiving the windfall are:

- He buys a £1,000,000 house (no mortgage)

- He buys a £200,000 car (no auto loan)

- He increases his annual spending from £40,000 to £100,000 p/a

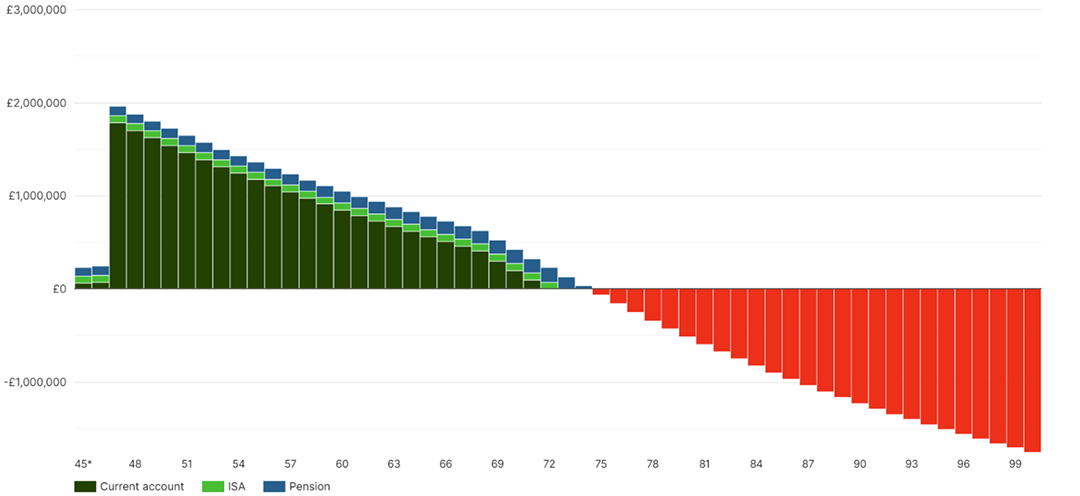

Scenario 1 (below) shows John actioning this without much thought. On this trajectory, he runs out of money by age 74, despite receiving a life changing windfall.

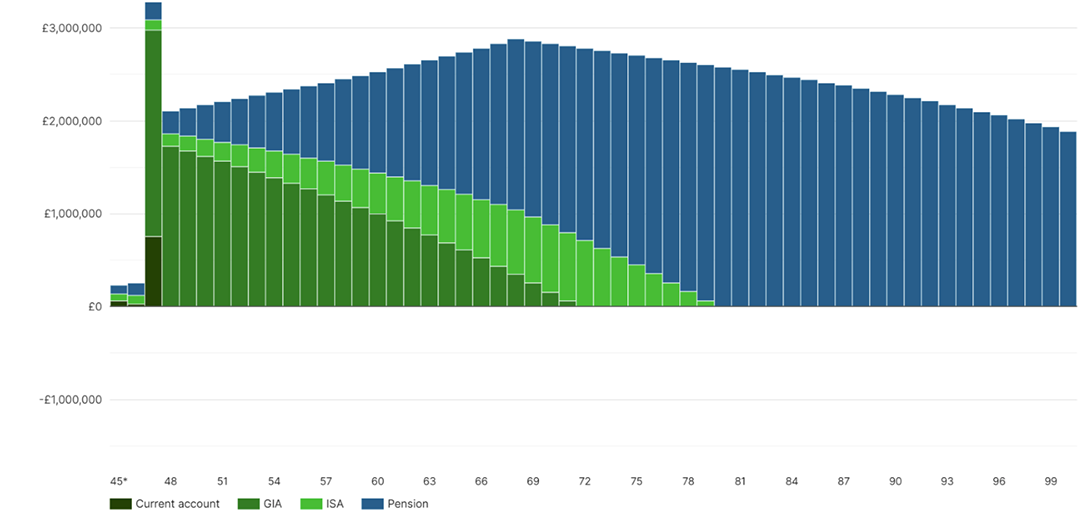

However, Scenario 2 shows John achieving all the same things, but working with a Financial Planner to establish an overarching Financial Plan first.

He still achieves his goals but can also sustain his lifestyle and still has £1,800,000 at age 100.

Scenario 1:

Scenario 2:

Step 3 – Assess Your Financial Situation:

If you follow step 2, a Financial Planner will guide you through all the following steps.

But whether you work with a professional or handle things yourself, the next step will be to conduct a thorough review and assessment of your current financial situation.

Evaluate your assets, liabilities, income, and expenditure to gain a clear understanding of your financial picture.

Identify if there are any clear pain points your windfall could help to alleviate, or eliminate entirely. Some examples might include:

- If you have any high interest debt, like an outstanding credit card balance that is costing you a lot in interest, this could probably be cleared.

- If you have no buffer (or emergency fund), and completely rely on your salary coming in each month, you could take 3-6 months’ worth of expenses and tuck that money away in a high interest savings account. This will ensure you have a buffer to rely on in the event of an emergency (and provide you with greater peace of mind in the meantime).

Step 4 – Set Clear Goals:

Now that you have taken some time to reflect (step 1) and you have a clear understanding of your current financial situation (step 3), you can face the future with far more clarity.

Establish clear and achievable goals based on your values, priorities, and aspirations.

Whether it’s retirement, financial freedom, purchasing a home, funding your children’s education, supporting charities that are close to your heart, or simply spending more time on your hobbies, articulate your objectives and create a roadmap to achieve them.

Step 5 – Create a Financial Plan:

Develop a comprehensive Financial Plan that outlines how you plan to manage your windfall.

Consider things like where money will be held, standard or tax-advantaged accounts, asset allocation and how money should be invested, risk tolerance and your timelines around when money will be needed, and the tax implications of your actions.

Your Financial Plan should be flexible, so that it can be adjusted to accommodate changes in your personal or financial circumstances, but also provides you with a structured framework for achieving your goals and living the life you want.

Revisit and update your Financial Plan yearly, to ensure you are staying on track.

Step 6 – Avoid Exciting “Investments”:

Exciting “investment opportunities” are usually closer to gambling than they are to investing.

Unfortunately, they usually capture the imagination because they provide hope that someone might “get rich quick”. However, that usually means they have the potential to destroy wealth too, which is even more dangerous when talking about large sums of money like a windfall – if you lose it, you won’t be able to save it back up again from your monthly income.

In recent years, meme stocks, NFTs, and even crypto currencies have fallen into this bracket.

Following a windfall, you will have no reason to chase high returns and your priority will be to protect the wealth that you now have.

Of course you want your money to work for you, but avoid “exciting” investment opportunities and protect your newfound wealth by investing your long-term savings in a globally diversified portfolio of stocks, bonds, and real estate.

This will ensure you grow your money in a robust, safe, and reliable way.

If you’re not sure where to start, a Financial Planner will be able to assist you in designing an investment strategy that aligns with your attitude to risk and your long-term objectives.

Step 7 – Inheritance Tax (IHT) & Estate Planning:

IHT & estate planning might not have been on your radar before now, particularly if your windfall has resulted in sudden wealth.

However, if you are British, then you – or your estate – will be liable to UK IHT (even if you live abroad, which is a common mistake made by many British expats).

Therefore, it’s very common for a windfall to push you into a position where you are suddenly exposed to UK IHT.

Once your net worth passes levels of around £500,000 (or £1,000,000 for a couple), you are exposed to IHT, which means that everything above that threshold will be charged at 40% upon death.

This can be particularly important if you have created a Financial Plan for the future and, based on your projections, you are confident that you have enough money to last for your lifetime and your asset levels are likely to remain above this level for the rest of your life.

In such cases, succession planning will likely be important to you and perhaps vehicles like trusts can play a useful role when it comes to safeguarding your wealth for your children, so that assets can be passed down through generations smoothly, tax efficiently, and at the appropriate times.

This can be further complicated by factors such as where you are resident, where you hold assets, your martial status, your dependents, or other family dynamics. As such, when it comes to effective estate planning, it’s always best to consult a professional and discuss your own personal circumstances.

Having an estate plan in place will reduce your exposure to IHT (and thus the tax bill on your estate), enable you to pass assets on to future generations as tax efficiently as possible, and ensure that your assets are distributed to your loved ones according to your wishes.

Conclusion:

Receiving a windfall presents a unique opportunity to either achieve – or fast track your way to – financial freedom.

By following these 7 steps and seeking professional guidance, you can effectively manage your windfall to live the life you always dreamed of, and potentially create a lasting legacy for generations to come.

The responsible stewardship of wealth requires careful planning, discipline, and focus on both the big picture and the long term.

At Abacus, we are here to help you navigate the complexities of sudden wealth or large windfalls, to ensure you maintain your course towards financial success.

By Technical Team @ Abacus

Please keep in mind that, whilst we aim to update these articles periodically, the content could be subject to future rule changes. Always make sure to speak to a qualified professional to ensure you have the most up to date information and are taking regulated advice around your specific circumstances.